Yesterday HMRC announced that they will be changing pension relief on net pay arrangements with effect from 6 April 2024 and that they will be paying a top-up to low earners. Hurray!

In a policy paper published 20 July, the Government stated, “There are 3 main methods of giving pensions tax relief. While they provide the same outcomes for most, low earners with taxable incomes below the Personal Allowance can have different levels of take-home pay depending on how their pension scheme is administered. Those in schemes using Relief at Source (RAS) receive a 20% top-up on their pension saving (even if they pay no income tax) whilst those in schemes using net pay arrangements receive tax relief at their marginal tax rate, such as 0%. The effect is that low earners in schemes using net pay arrangements have less take-home pay than they would if they were saving into a scheme that uses RAS.

The government believes it is right to rectify this anomaly. The government will pay a top-up to low earners making contributions to pension schemes using a net pay arrangements in 2024 to 2025 onwards. In the following tax year, HMRC will notify those who are eligible and invite them to provide the necessary details for the top-up to be paid direct to their bank account.

As a result of this change, low earning pension savers should receive similar outcomes regardless of how their pension scheme is being administered for tax purposes.”

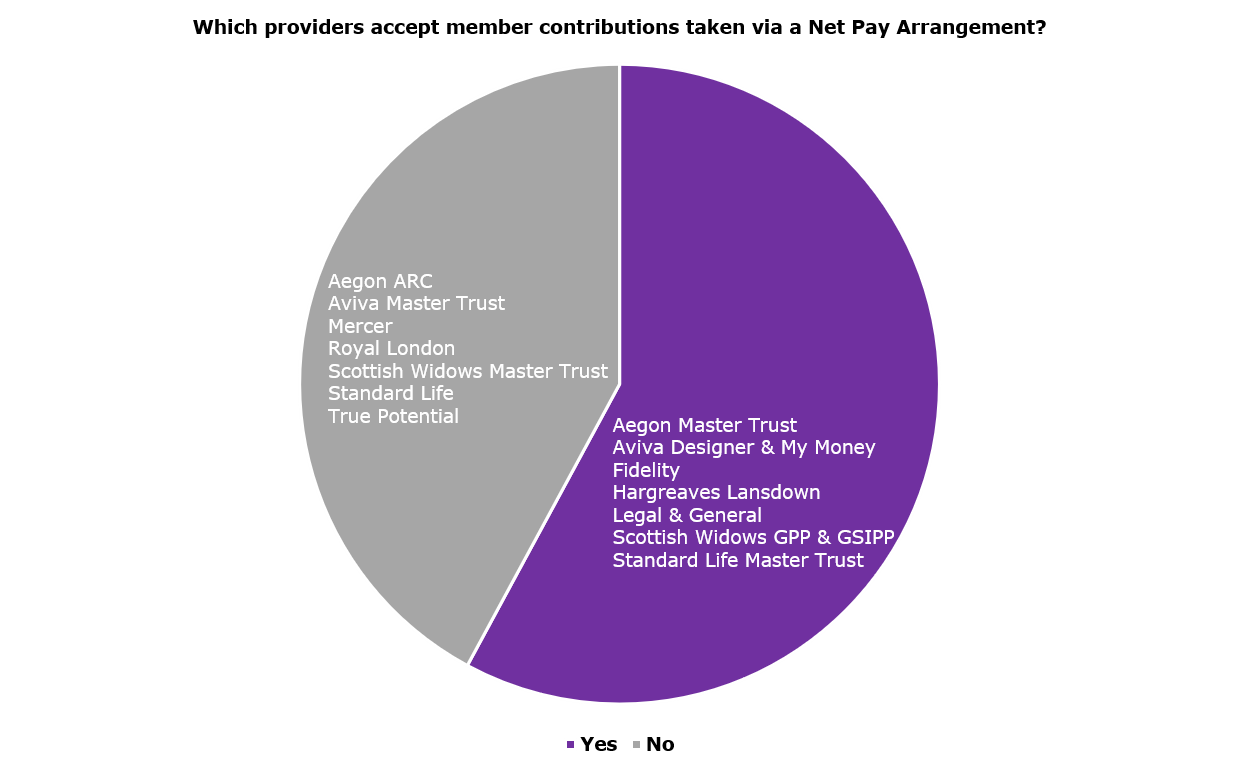

We have previous looked at which providers operate a net pay arrangement and although it is too soon to see what practical changes (if any) this might mean for providers, it is worth recapping on which providers currently offer what……

There are two different ways that workplace pension schemes can set up pension arrangements to collect the tax relief that savers benefit from when saving towards a pension. These are net pay and relief at source.

When a member contributes to their workplace pension, a relief at source arrangement means their contributions are taken from their net pay. The workplace pension provider then automatically claims tax relief for the member’s pension from HMRC. They then add the basic tax rate of 20% to the member’s pension contributions.

In simple terms this mean that if a worker had pensionable earnings of £1,000 with a 1% pension contribution, with a relief at source arrangement they would have £8.00 deducted from net pay and paid to the pension provider. The provider would then claim an additional £2.00 from HMRC, so that a total of £10.00 is paid into their pot.

Via this method the member would get the basic 20% rate in tax relief added to their pension savings, even if they do not actually pay tax. It is therefore particularly popular with employers where a large proportion of their workforce earn below the tax threshold and/or work part time.

A net pay arrangement means that a member’s workplace pension contributions are taken from their gross pay before wages are taxed. Therefore, the member only pays tax on what remains of their salary and receives their full tax relief immediately based off their income taxpayer rate.

If a worker had pensionable earnings of £1,000 with a 1% pension contribution, then under a net pay arrangement they would have £10.00 deducted from gross pay and £10.00 would be paid to the pension provider.

By choosing a net pay arrangement, any members who are earning less than £12,500 (in the 2020/21 tax year) would not receive tax relief on their workplace pension as they do not earn enough to pay tax. Therefore, net pay arrangements tend to be more popular with employers who have a high proportion of skilled workforce.

Whilst this may seem like good news for employers with a skilled workforce, our data shows that they may find their workplace pension provider is unable to support this arrangement.

Our data shows that only just over half (55%) of providers can accept member contributions taken via a net pay arrangement.

However, with the new changes coming into force April 2024, this may no longer be an issue as all members will effectively be treated the same with no disadvantage. For further details from HMRC, click here.