There are many factors by which it is possible to measure a workplace pension provider, from quality of service, through to investment choices and member engagement. In this series of insights, we look at some of the key factors which should be considered when evaluating what makes a good workplace pension and what delivers the best outcomes for members.

When choosing a workplace pension provider it can be easy to get overwhelmed with the number of choices out there. There are many different elements that make up a good workplace pension and what makes a good workplace pension for one employer/member may not suit another.

However, there are several aspects of a workplace pension that are important to some extent to all employers and members. Namely the investment choices, governance, communication and engagement, administration and servicing, charges and additional benefits products.

Investment choices

At their core, workplace pensions are a form of investment. Therefore, the choice of investment options that are available are key when considering what a good workplace pension looks like. Our data shows the number of funds and non-core investment options vary from a carefully chosen few to a mind boggling over 3,000 choices.

Standard Life DC Master Trust have the smallest choice of available funds on their platform with less than 25 funds on offer to choose from. Hargreaves Lansdown, Aegon Workplace ARC, and True Potential offer the widest choice of funds with over 3,000 on offer.

However, more funds does not necessarily mean a better workplace pension. The type of funds available, how they are managed and how they perform need to fit with the needs of the member.

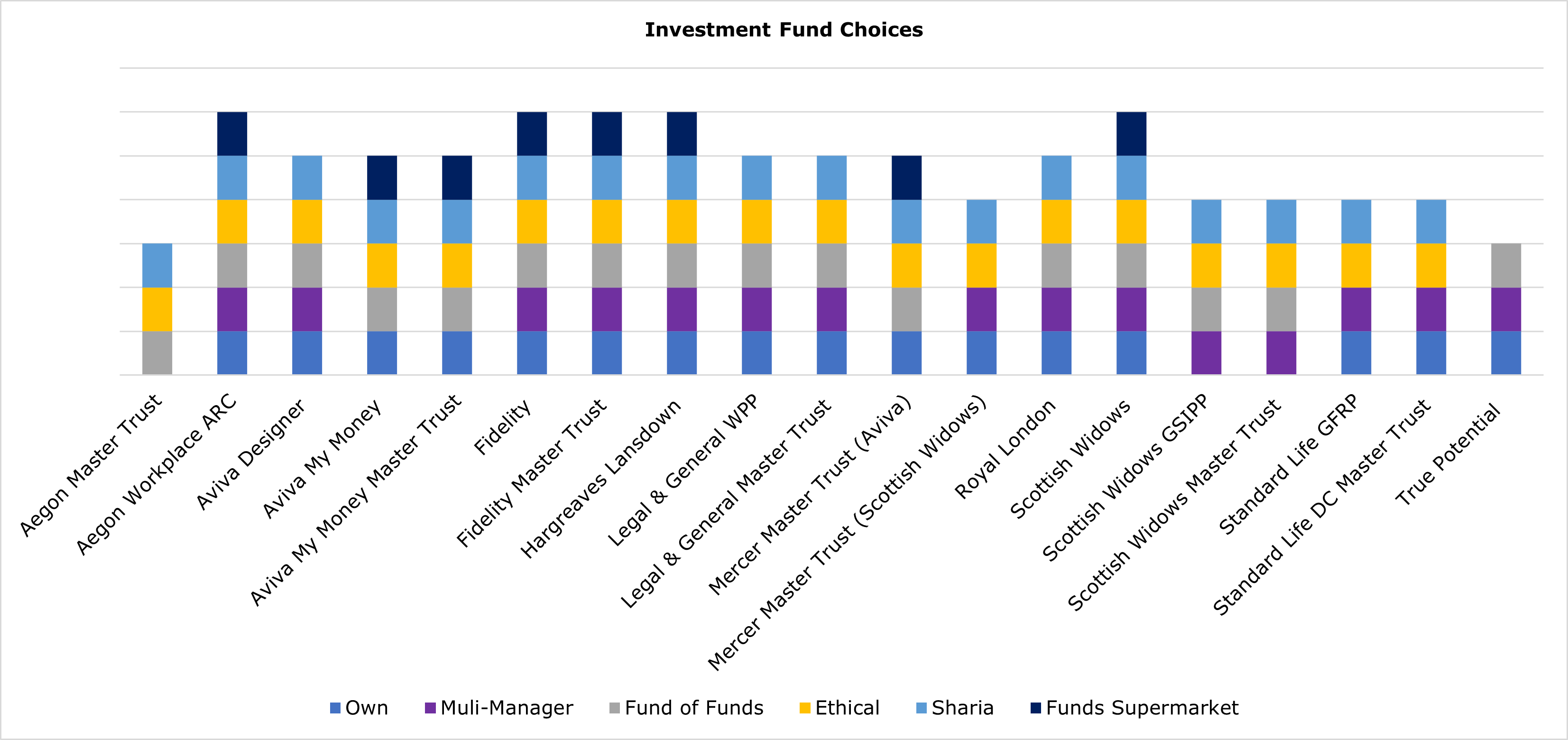

The majority (80%) of providers offer their own funds, which are available both offline and online. Those who do not offer their own funds are Aegon Master trust, Scottish Widows GSIPP and Scottish Widows Master Trust.

Over the past year, responsible investing has taken off in popularity amongst investors. This month there has already been big announcements from both Cushon and Scottish Widows (we will be looking at responsible investing in detail in a future insight). In the latest data from the Investment Association (November 2020 fund sales), responsible investment funds now make up 3% of all retail investment funds under management. When it comes to the type of funds offered by workplace pension providers, it is perhaps therefore not surprising that the vast majority of providers can offer ethical funds to their members both online and offline. True Potential is the only workplace pension provider who does not currently offer an ethical fund choice.

Fund of funds are also a popular choice offered by the majority (80%) of workplace pension providers. The providers who do not offer these are Mercer Master Trust Scottish Widows, Standard Life, and Standard Life DC Master Trust. Other providers offer these both online and offline.

Multi-manager funds are also offered widely with 75% of workplace pension providers listing them both online and offline as an option for their members. Those who do not offer these are Aegon Master Trust, Aviva My Money, Aviva My Money Master Trust and Mercer Master Trust Aviva.

The Sharia compliant finance sector has grown in recent years. Western financial services firms are increasingly beginning to offer Sharia-compliant investment vehicles. Muslim Sharia law establishes guidelines for investment and banking, including not collecting interest or benefiting from gambling, therefore compliant funds open the world of workplace pension funds to Muslim workers. Our data shows that, other than True Potential, all workplace providers now offer Sharia compliant funds.

For those for whom a large choice of funds is important, a link to a fund supermarket through their workplace pension provider can be attractive. Under half of workplace pension providers (40%) link to a fund supermarket. Those who do are Aegon Workplace ARC, Aviva My Money, Aviva My Money Master Trust, Fidelity, Fidelity Master Trust, Hargreaves Lansdown, Mercer Master Trust Aviva and Scottish Widows.

It is not just the choice of investment fund that makes a good workplace pension provider in terms of investment choices. Risk ratings and investment governance are also important.

In order to be confident that they will have enough money to fund their retirement, workplace pension providers need to be confident in taking a level of risk. Once this level of risk has been identified and/or reviewed, the process of mapping investments to this level of risks can begin.

Our data shows that 85% of workplace pension providers risk rate their funds. Those who do not are Mercer Master Trust Scottish Widows, Scottish Widows GSIPP and Scottish Widows Master Trust.

Many workplace pension providers state that over nine out of ten members end up using a default fund, therefore how this fund is managed is critical when it comes to considering what makes a good workplace pension.

Our data shows that all workplace pension providers have a core default fund which is used for auto-enrolment, with the number of members currently investing in this strategy varying from 25,000 to over a million.

With the growth of popularity of ethical investing it is not surprising that almost three quarters (70%) of workplace pension provider default funds invest in funds which adopt an ESG screening process. Those who currently do not are Aegon Workplace ARC, Fidelity, Fidelity Master Trust, Hargreaves Lansdown and True Potential

Investment governance

How the investment strategies in a workplace pension are managed can make a big difference to the members, and therefore it is important to consider governance when it comes to considering what makes a good workplace pension.

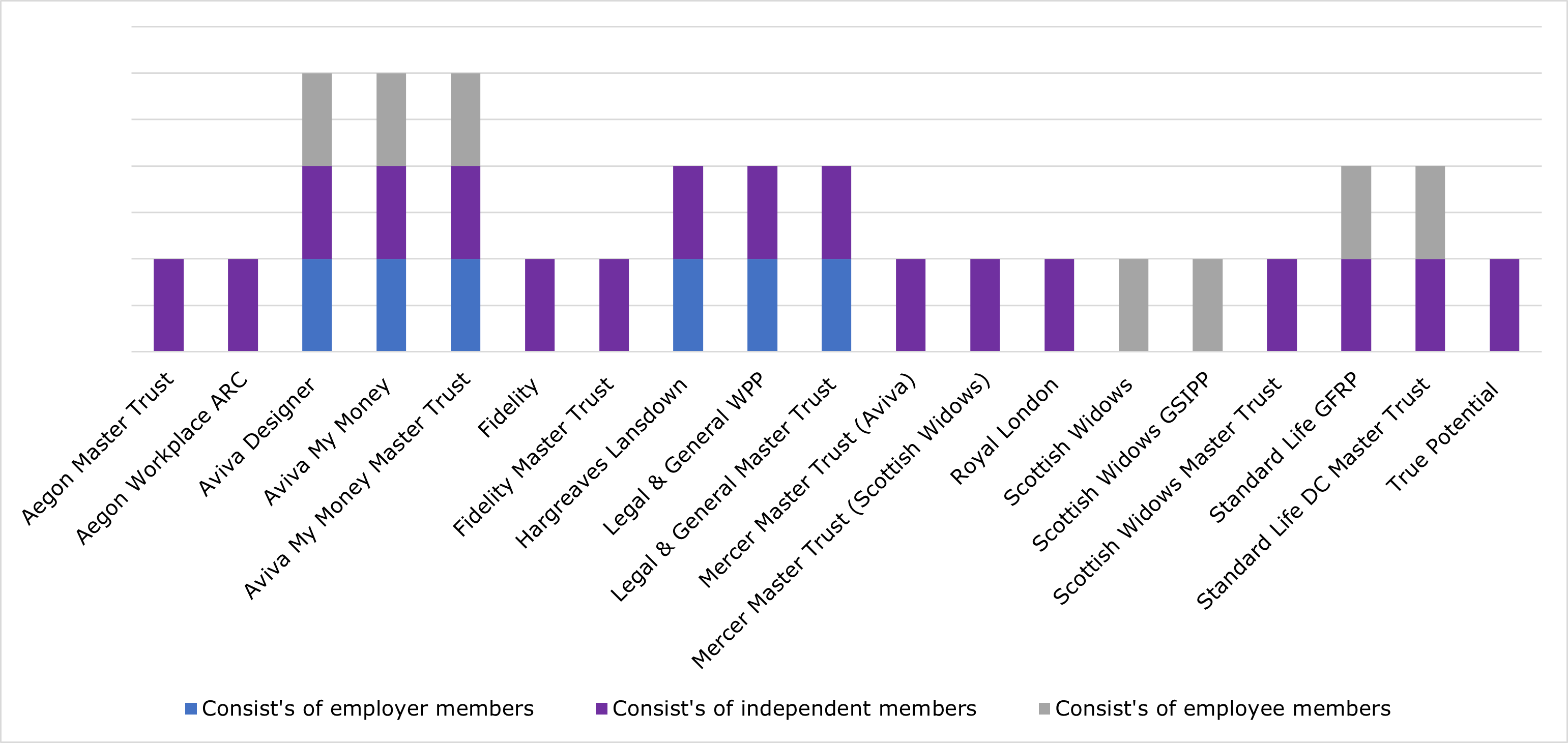

Our data shows that all workplace pension providers have an investment governance team who monitor the overall investment strategies, but the make-up of these teams vary.

The majority of providers (90%) have independent members on their investment governance team. A smaller 30% have employer members and 35% have employee members.

All workplace pension providers consider the level of risk attached, the investment objective, whether charges are clear and transparent, and how on-going costs, charges and transactions can erode the value of the members’ account when deciding which funds to make available to members.

Many workplace pension members may consider how good their workplace pension is solely by looking at its investment performance, and how well these sit in line with their objectives.

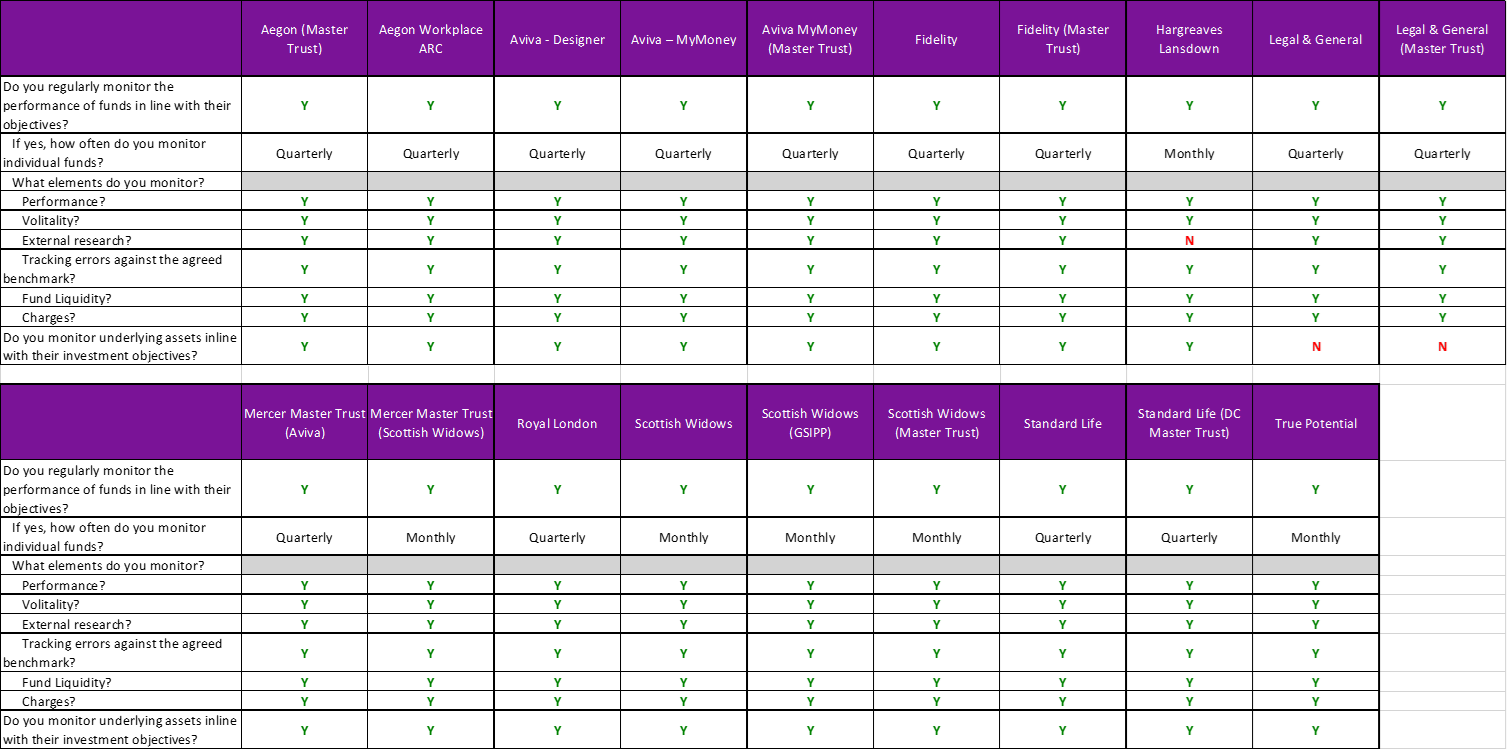

Our data shows that all workplace pension providers regularly monitor the performance of funds they offer to members. The majority (70%) do this on a quarterly basis. However, Hargreaves Lansdown, Mercer Master Trust Scottish Widows, Scottish Widows, Scottish Widows GSIPP, Scottish Widows Master Trust and True Potential do this on a more regular monthly basis.

Other than Hargreaves Lansdown, all workplace pension providers monitor performance, volatility, external research, tracking errors against the agreed benchmark, fund liquidity, and charges.

Hargreaves Lansdown monitor the same elements other than external research.

Only Legal & General and Legal & General Master Trust do not monitor underlying assets in line with their investment objectives.

The second instalment of this insight will be published Tuesday 18th February and the look more closely at the providers approach to online access, digital engagement, servicing and administration, charges and what other products and services members value from a workplace savings proposition.