Open banking is rapidly growing in popularity with more than two million consumers now using open banking-enabled products. However, only three of the workplace pension providers in our analysis currently use any form of open banking technologies as part of their proposition.

Open Banking was delivered as a solution to EU PSD2 (Payment Services Directive 2) and overseen by the Competition and Markets Authority (CMA).

The Open Banking standard was published in early 2016, which stated that the nine leading banks in the UK (Allied Irish Bank, Bank of Ireland, Barclays, Danske, HSBC, Lloyds Banking Group, Nationwide, RBS Group, Santander) must all deliver current account information via a common API.

An Open Banking Implementation Entity (OBIE) was formed to deliver the specifications and technical components required for security, standardisation and dispute resolution. The UK API was delivered by OBIE and the nine banks in early 2018 and is now being used by Third Party Providers who are regulated under PSD2.

Over the last few years there has been a significant upswing in the use of open banking technology despite, or perhaps due to, the disruptive effects of the Covid-19 pandemic, according to figures from the Open Banking Implementation Entity (OBIE) released at the start of October.

User numbers shared by the OBIE have doubled since January 2020, with a steady monthly increase of users every month as more consumers used money management apps for the first time as the pandemic hit.

However, workplace pension providers are largely behind the open banking curve. Our data shows that only three providers currently use open banking technologies.

Most consumers currently using open banking are utilising it to better understand their bank accounts, according to the OBIE. They are looking at how they are spending their money, how they can save more effectively, and what tools they can use to help them manage their income, expenditure and debt.

Therefore, it is reasonable to expect that these consumers would also benefit from having access to their workplace pension scheme data via open banking, along with all other assets and liabilities to provide an overall picture of someone’s finances.

It seems this is a thought shared by several workplace pension providers. An additional 19% of providers in our research are planning to implement open banking technology by the end of next year. These providers are Aegon and Fidelity. Fidelity told us they are planning on developing their own open banking technology, whereas Aegon have not yet confirmed their approach.

Of the three workplace pension providers already using open banking technologies, one has developed their own technology whereas the others are using third party. Unsurprisingly it is Scottish Widows who have developed their own technology from their banking giant parent Lloyds Bank. This allows users who bank with Lloyds and have a workplace pension with Scottish Widows to see their pension and banking accounts side-by-side in one app.

The Moneyhub technology is currently being used by Mercer Master Trust and True Potential have opted to partner with Yodlee.

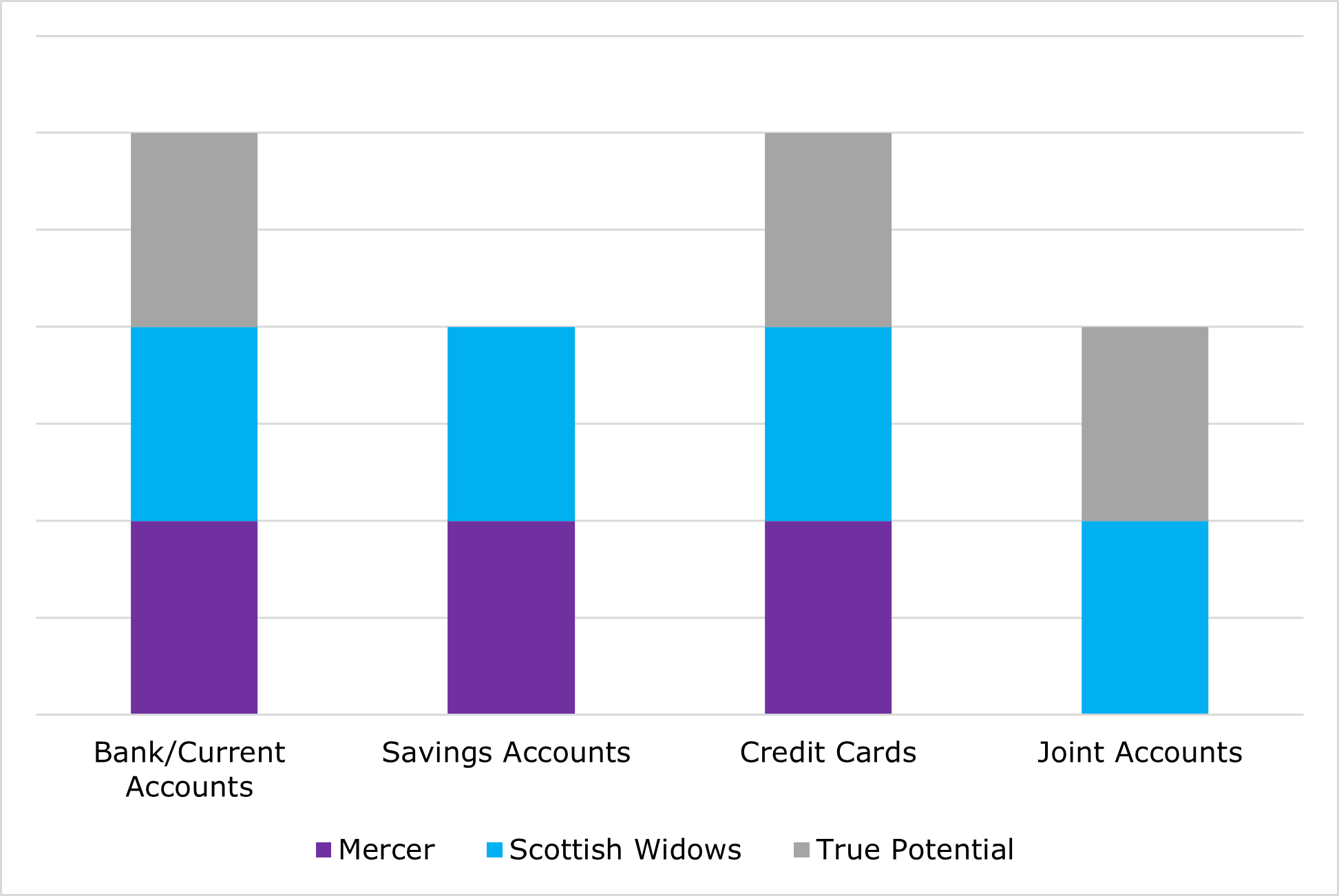

The providers using open banking can currently all use the technology with bank/current accounts and credit cards. All but True Potential are able to use open banking technologies with savings accounts. Scottish Widows and True Potential are also able to include joint accounts. Both of these providers are also all registered as an Account Information Services Provider (ASIP).

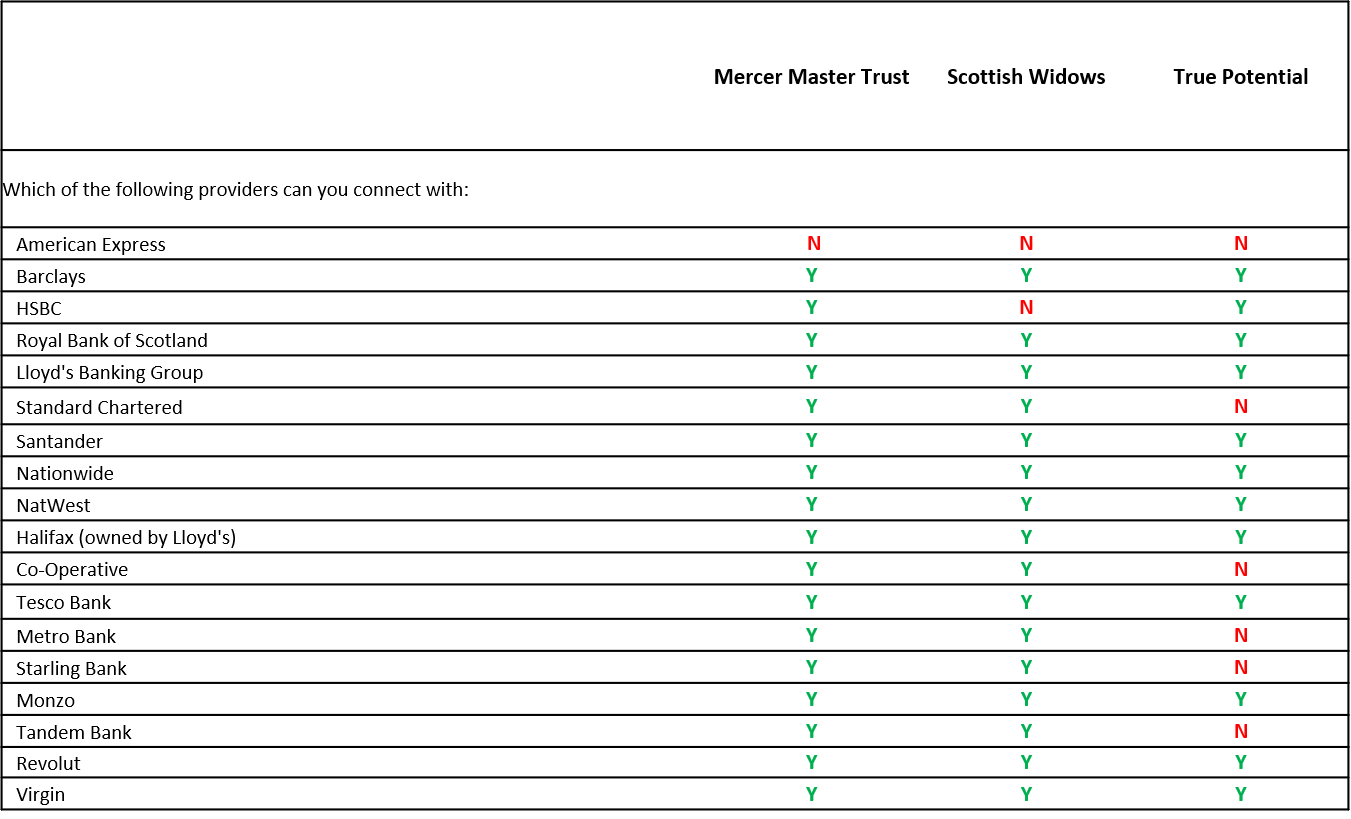

When it comes to integrating with banks to share data, Mercer currently can connect to virtually all major banks and credit cards, with the exception of American Express. Scottish Widows are similar, with the addition of HSBC and True Potential have a fair spread, but not all.

No workplace pension providers’ open banking technology is yet able to support non-UK bank accounts, however they do not have any limit on how many UK accounts a user can connect.

Another area where the open banking technology offered by workplace pension providers differs in is how many months transaction history a user is able to view. Mercer Master Trust and True Potential all offer 12 months on average. However, Scottish Widows only allow 3 months to be viewed on their personal financial management portal.

What users of the providers personal financial management portals are able to see at first is fairly similar across the workplace pension providers that offer open banking. Once a previous transaction history is captured, all providers will automatically categorise each transaction based on the merchant code. Meaning at a glance users can see where they are spending their money.

When it comes to the spending categories, Scottish Widows are more restrictive than the other two providers. Unlike the other providers, they limit the number of possible spending categories to 50 and do not let users re-categorise or add their own categories.

This is an area where we have great insight on what each of pension providers are offering which will be explored in future insights.

The use of open banking can really help a user get a better understanding of their finances and help them to better manage their money. It is great to see that Mercer, Scottish Widows and True Potential are incorporating this into their workplace pension propositions and that others are due to follow suit next year. Providers who have access to data from open banking are perfectly placed to help their members in the wider context of financial wellness and we are excited to see what 2021 brings.