Since April 2015, workplace pension members over the age of 55 have had more freedom and choice about how to access their pension savings. Statistics from the Department of Work and Pension have shown that the total value of flexible withdrawals from workplace pension since the changes has now exceeded £37bn.

We would have all worked hard throughout our careers to build a pot of money, which will hopefully be sufficient to support us through our later years, therefore choosing what you do with that money once it is available is a huge decision. The Coronavirus pandemic has seen many people change their retirement plans with some considering accessing their savings early and taking advantage of options now available to them.

In the simplest terms there are really four options which are available (although there can be different variations of these). All have different rules and tax implications, and financial advice should be taken where appropriate.

1. Securing a guaranteed income for life by purchasing an annuity product

2. Leaving your pension invested and drawing an income, either as regular payments or as needed via a drawdown option

3. Have the pension paid out as a cash payment, either in one lump sum, or over a series of smaller payments

4. A combination of the above

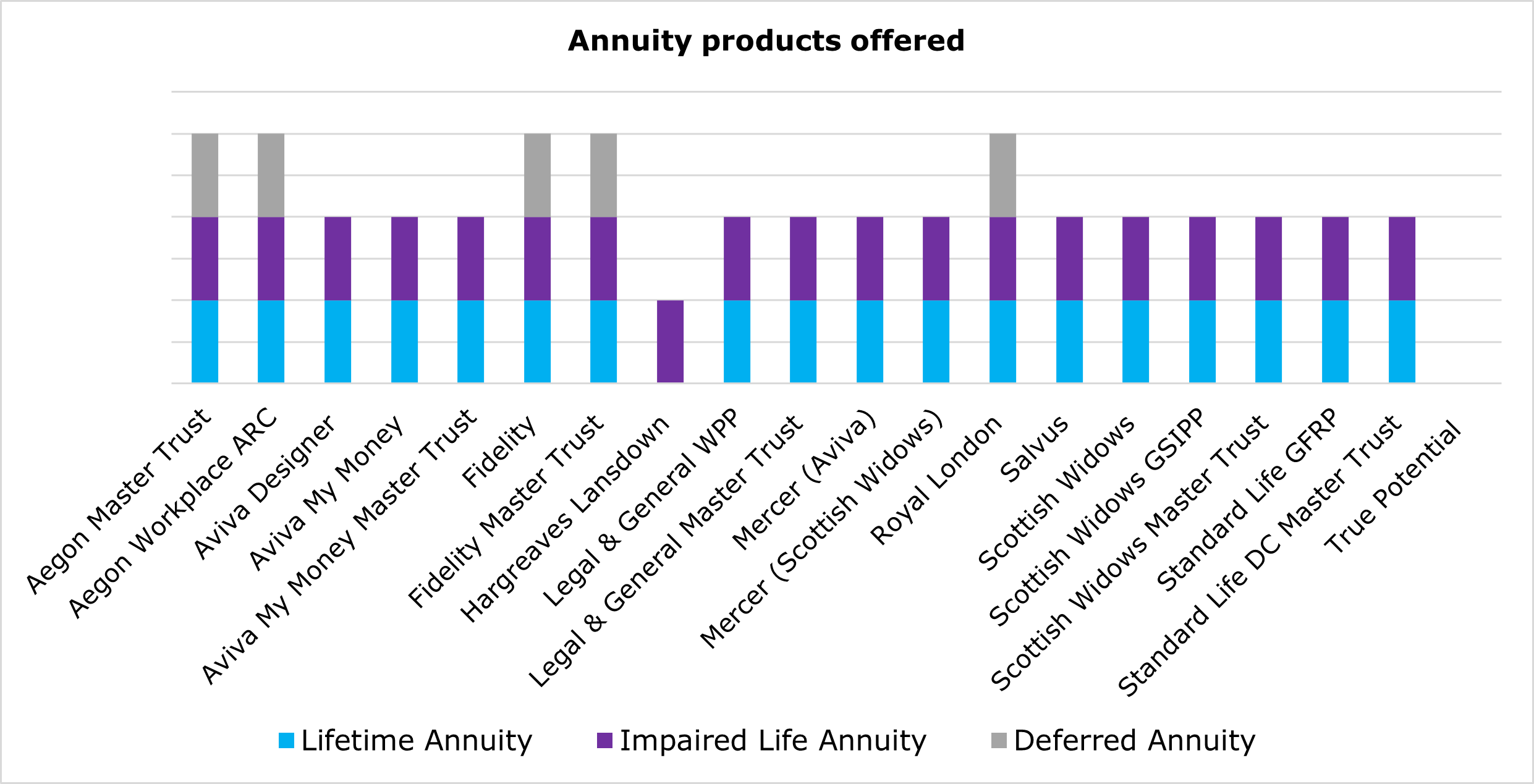

Our data shows that when it comes to the various products available to members looking to take advantage of the new freedoms there are some differences between the providers.

The most widely offered annuity product is an impaired life annuity. The majority (90%) of providers offer this. Lifetime annuity products are offered by 86% of providers and less popular are deferred annuity products being offered by only 24% of providers.

True Potential are the only providers who do not currently offer any form of annuity product as part of their workplace pension proposition.

Flexible access drawdown products have become an important part of the pension freedoms product picture and our data shows that all providers offer these as part of their proposition and have also all confirmed that they allow members to make ad-hoc withdrawals.

When a member is looking to take a new drawdown product, 19% of workplace pension providers require them to take a new policy. The remainder allow the member to take it under an existing arrangement.

Three-quarters of workplace pension providers can facilitate adviser charging from a combined flexible access drawdown facility and a third of providers have applied withdrawal restrictions to their flexible access drawdown product.

When it comes to transfers, our data shows that all workplace pension providers will accept direct transfers from a member without any adviser input.

Another product growth area for workplace pension providers is savings products which enable members to reinvest cash payments from their corporate pension(s). Our data shows that 81% of providers have such a savings product on offer with an additional 14% currently developing one.

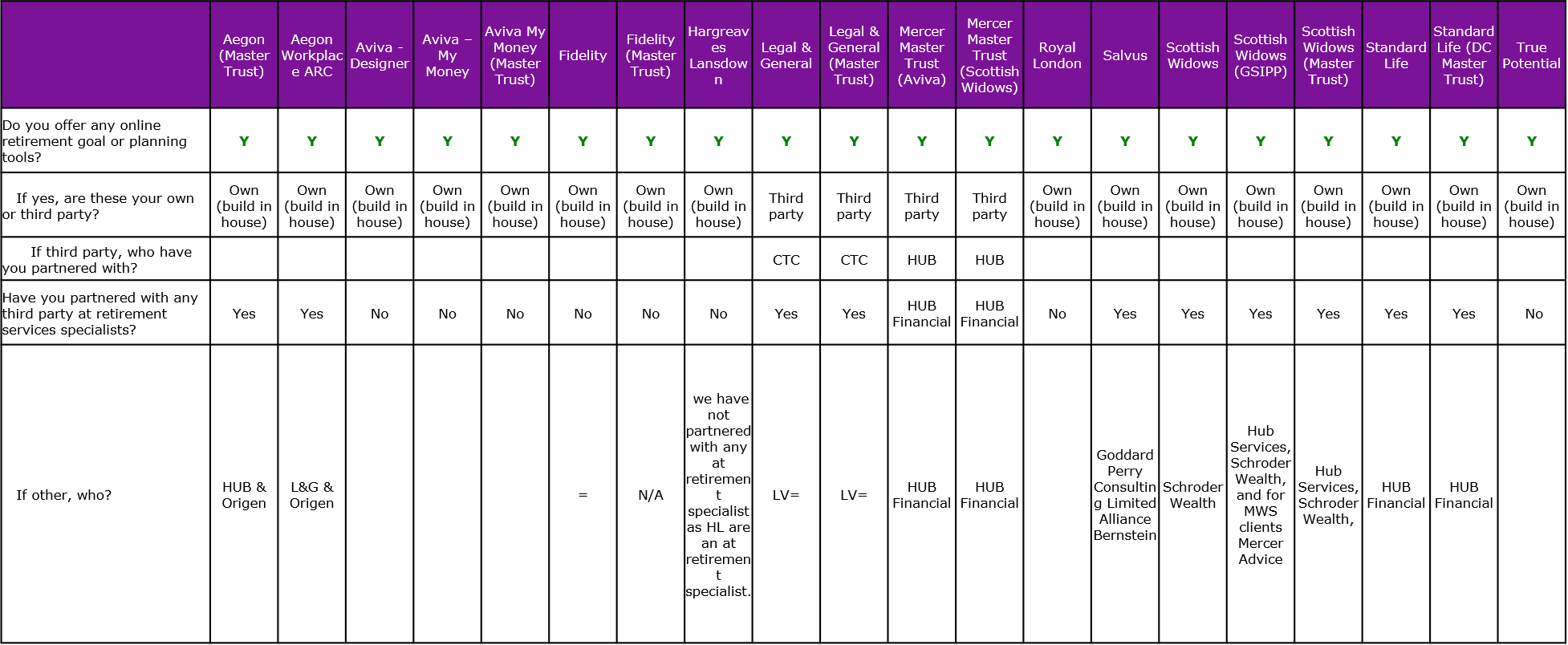

Our analysis also confirms that all workplace pension providers are offering various tools and support for advisers to assist them with the pension freedom changes.

Such tools can be particularly helpful for advisers looking to illustrate to their clients’ what effect taking their pension earlier could have. These enable advisers to illustrate clearly to their client the potential effect the various options they now have under pension freedoms could have on their retirement income. It is no real surprise that our data shows that all providers offer these.

For the most part such tools are the providers own and built in-house, however two providers are using third party software. Legal & General have partnered with CTC Software for theirs and Mercer Master Trust are using technology from HUB Financial.

All but two providers are able include third party pension holdings within their tools and modelling. True Potential and Royal London are the only two who just include their own pension assets, which could cause issues in understanding someone’s entire financial plan. Ideally such tools should have the ability include all pension assets, regardless of where they are held.

With more people looking to take advantage of early retirement options offered by pension freedoms, many workplace pension providers are partnering with third party retirement specialists.

Our data shows that almost 75% of providers have entered into such partnerships.

Making decisions about what do when you reach retirement can be very daunting, therefore we are pleased to see that overall, most workplace pension providers have embraced pension freedoms and are offering products, tools, and services to help advisers navigate the changes with their clients.

An area which is growing in interest is the application of digital retirement advice and technology which can help make better decisions. This is a subject that we will be exploring in a future insight, looking at how this can be applied and who is currently offering what.