Getting people actively interested in their workplace pension is notoriously difficult, but important if it can make a positive difference to their retirement prospects. The more interesting people find something, the more likely they are to make the effort to understand it. Then the more we understand something, the better equipped we are to make decisions relating to it.

Financial Education is high on the agenda of all providers. Financial education is rather a loose term and could be interpreted in many ways, but as a general statement we are pleased to see that all providers are full supporting the process and working with members (and advisers and trustees) to provide support and guidance where possible.

All providers are providing basic online material about what a pension is and most will signpost member to services such as Pension Wise, The Pensions Advisory Service and The Pensions Regulator.

However, pensions and choices can be confusing. Even advisers who deal with pensions day in, day out say they pension can be more complicated than they really should be. Strip the complexity away and a pension is a relatively simple idea of saving some money from your earnings throughout your working life to pay for your lifestyle when you retire. However, once that simple concept is applied to individual circumstances, the implications of different choices over the long term and the tax system – because a pension is a tax wrapper – come into play, which complicate matters.

The shift from defined benefit to defined contribution pensions and the flexibility brought into the DC world by the pension freedoms has meant there is more choice but also more investment risk for individuals in saving for retirement, so they need to understand those choices and risks.

What they invest in, how much it costs, when they expect to retire and how long their retirement income will need to last all feed in to whether someone can achieve the type of retirement they want, with the money they have at their disposal. Where the sums don’t add up, people need to take on board the prospect of working longer that they had originally planned or adjusting their financial expectations in retirement. As the old proverb says, you have to cut your coat according to your cloth.

However, it doesn’t help employees that information about their pensions often involves the use of industry jargon – a kind of regulatory/legal shorthand that can often confuse people outside the pensions world. If people don’t have confidence in financial matters because they don’t understand enough about it, it’s not easy for them to go to their employer and say ‘hang on a minute, what does this really mean in plain English?’

Workplace pension providers know all this, which explains why all the providers in our analysis support their members in understanding how good their level of financial knowledge/education is. However, there is some variation between propositions in how this support is delivered.

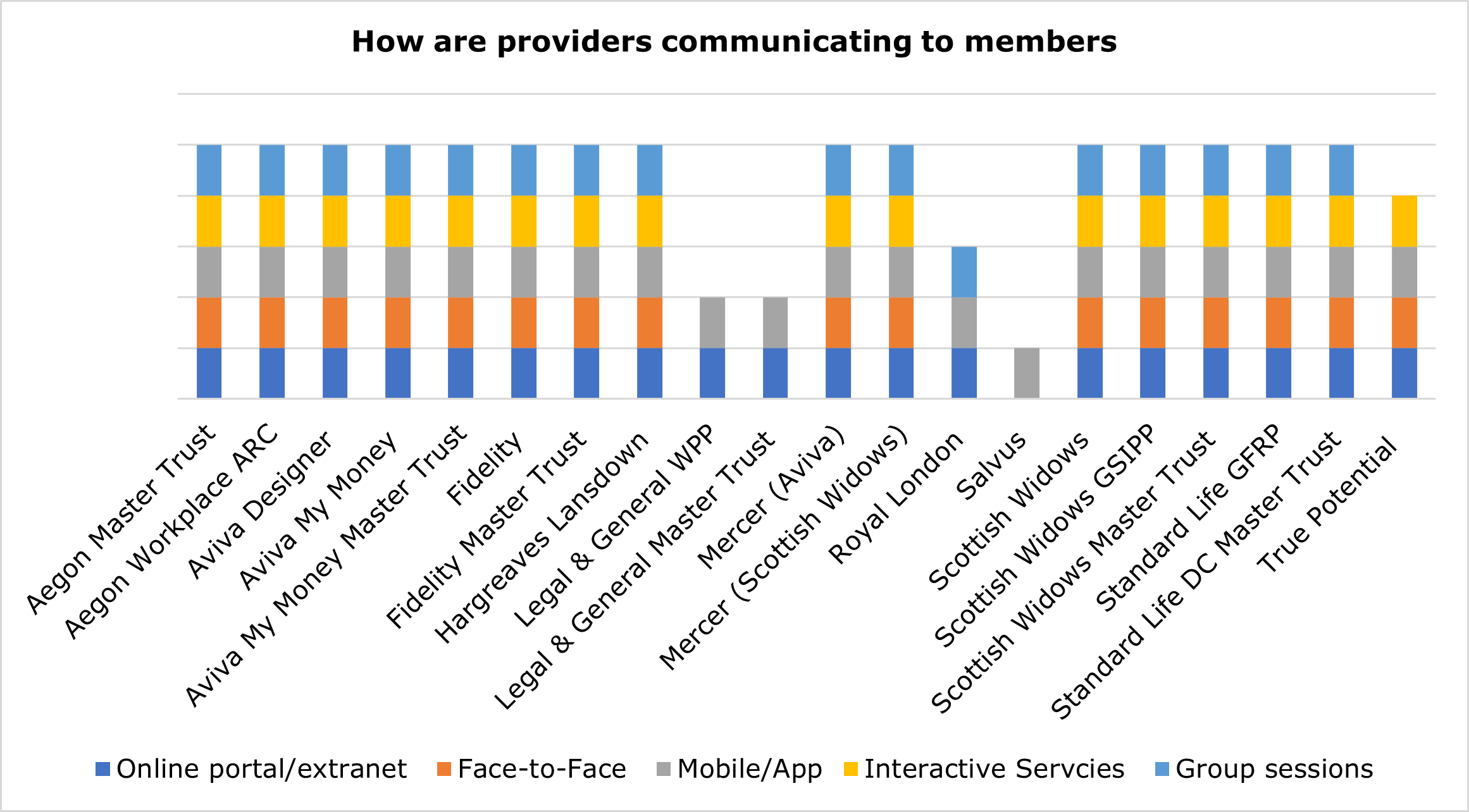

App or mobile phone is the most popular method for helping clients understand their level of financial knowledge/ education, with all propositions offering this type of support. As you would expect, online is the most popular and group sessions are also common among 17 out of 20 propositions. Slightly fewer offerings – 16 out of 20 propositions – deliver face-to-face support and interactive services, although in a Covid world this is obviously not happening, and like everyone else the adoption of screenshare and video calls are increasing.

Some providers such as Legal & General seem to be focusing on digital methods of communication which explains why they do not offer support through the other channels available.

Financial education doesn’t begin and end with pensions, so it was encouraging to see that the vast majority of providers support members in building/improving their general financial knowledge. This can cover topics such as explaining a credit score, budgeting or the importance of having some cash for emergencies.

Again, there is some variation between providers in terms of how they deliver general financial education. Following the same pattern as earlier, online, through an app or a mobile device popular among providers delivering educational support, with group sessions, face-to-face and interactive services slightly less common.

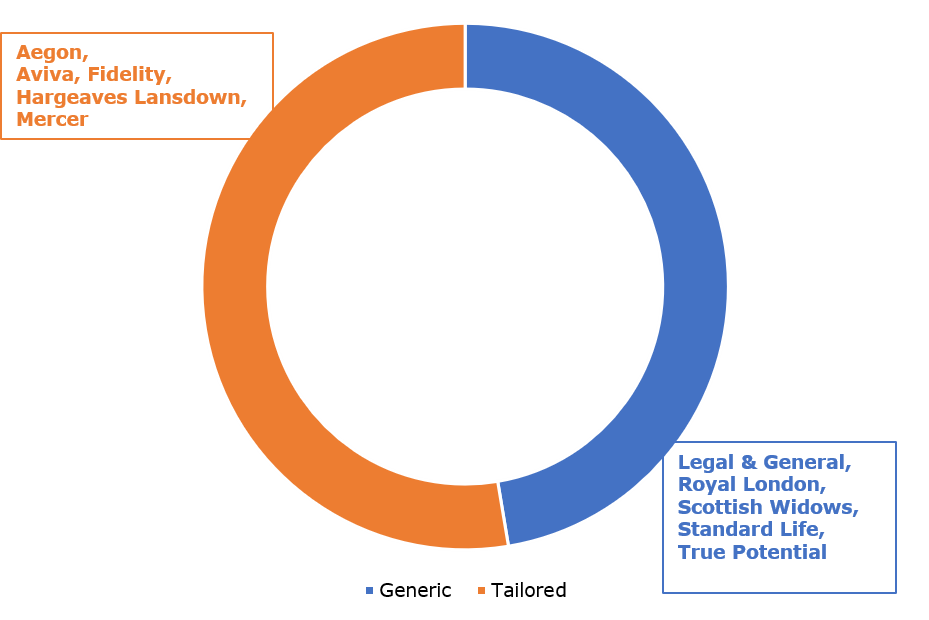

Educational content can be generic or sign posting to third party resources, or it can be tailored and more personalised to members of workplace pension schemes, so that it relates to key characteristics about them such as their age, whether they are married or have children.

Our pie chart shows a pretty even split between both types of content. Of the 19 propositions which supplied information for this part of our research, ten provide tailored information and nine offer generic information.

A closer look at those providing tailored information show that the vast majority take the same factors into account to deliver ‘a bespoke and meaningful service’ to clients. Current age, retirement age, income and expenditure, and family status – whether members are single, married and have children – are regarded as equally important by providers.

Responses are mixed when it comes to whether tailored information can include bespoke content provided by the employer. An employer may well have other third party financial wellness material or educational content that they want to include with information provided by their scheme provider. Most providers – 12 out of the 17 propositions supplying data – do allow for bespoke content from employers to be included with their own.

We will be exploring education further in next weeks insight when we take a deeper look at what wider member and adviser educational support is available from pension providers.