Auto-Enrolment means that all employers now need to offer a qualifying workplace pension, but some providers make the management of ongoing pension duties easier for the employers than others. This insight looks at which providers are offering employers the most support in this area and who can make the process of managing ongoing Auto-Enrolment duties easier.

Introduced by the Pensions Act 2008, Auto-Enrolment introduced a statutory duty on employers to assess their workers and enrol those who met the criteria into a qualifying workplace pension scheme.

Staging dates began in October 2012, with all employers supposed to comply by February 2018. The vast majority of employers will now have a workplace pension to offer their employees but may be receiving a very different service from their provider when it comes to helping them manage their ongoing pension duties each month.

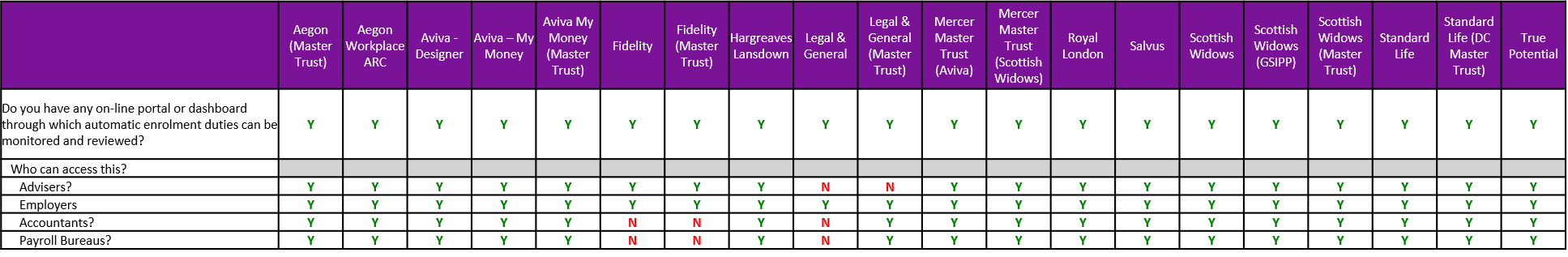

Our data shows that all workplace pension providers have an online portal or dashboard through with automatic enrolment duties can be monitored and reviewed by employers. This will be a key system which employers will use each month to manage their on-going requirements and ensure that they are meeting all their employer duties and are fully compliant.

Although our data shows that all employers have access to such a dashboard, that is not the same for other key actors. When it comes to accountants and payroll bureaus, the picture is a little less harmonious. The majority (86%) of providers offer access to their dashboard through which auto-enrolment duties can be monitored to both accountants and payroll bureaus. Fidelity, Fidelity Master Trust, and Legal & General are those who do not.

All providers other than Legal & General will also offer access to advisers.

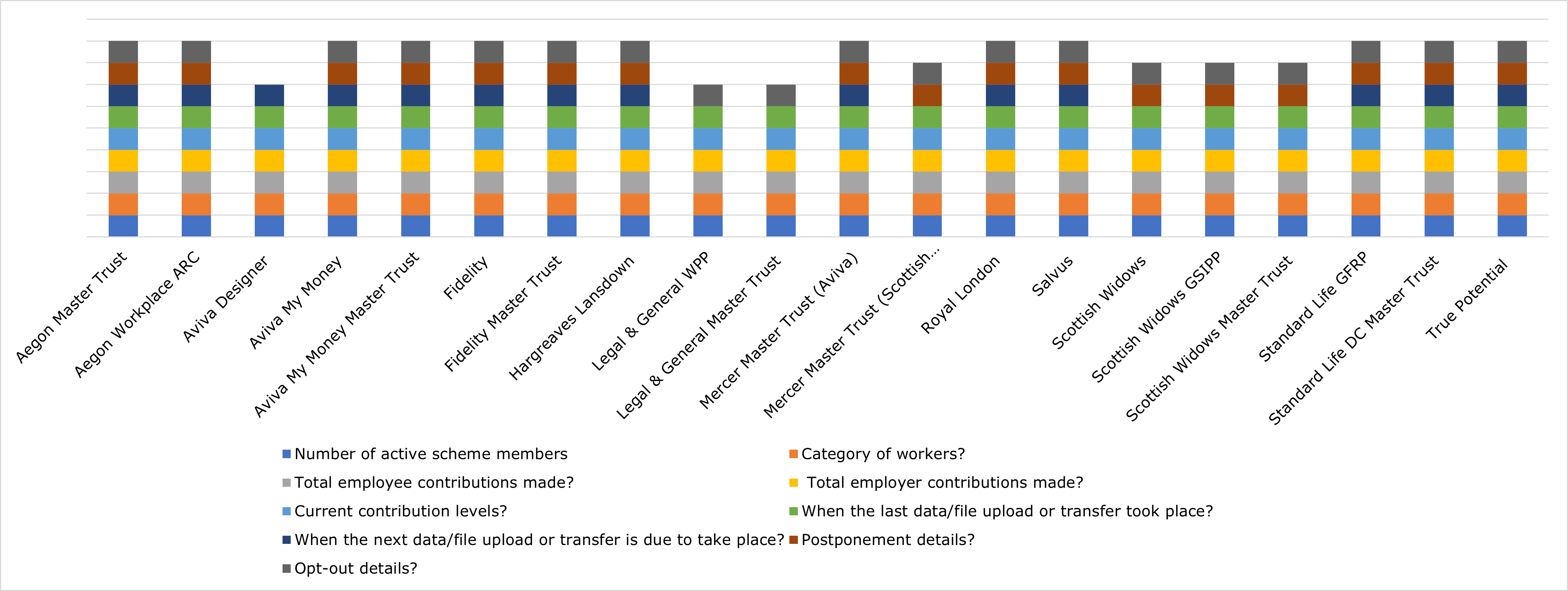

In terms of what information can be accessed, our data shows that out of the online portals/dashboards, all providers offer information on the number of active scheme members, category of workers, total employee contributions, total employer contributions and when the last data/file upload or transfer took place.

Postponement details are displayed by 80% of providers, whilst opt-out details are displayed by 91%.

Our data also shows that only three quarter of providers display when the next data/file upload or transfer is due to take place. Those who do not offer this are Legal & General, Legal & General Master Trust, Mercer Master Trust (Scottish Widows), Scottish Widows, Scottish Widows (GSIPP), and Scottish Widows Master Trust.

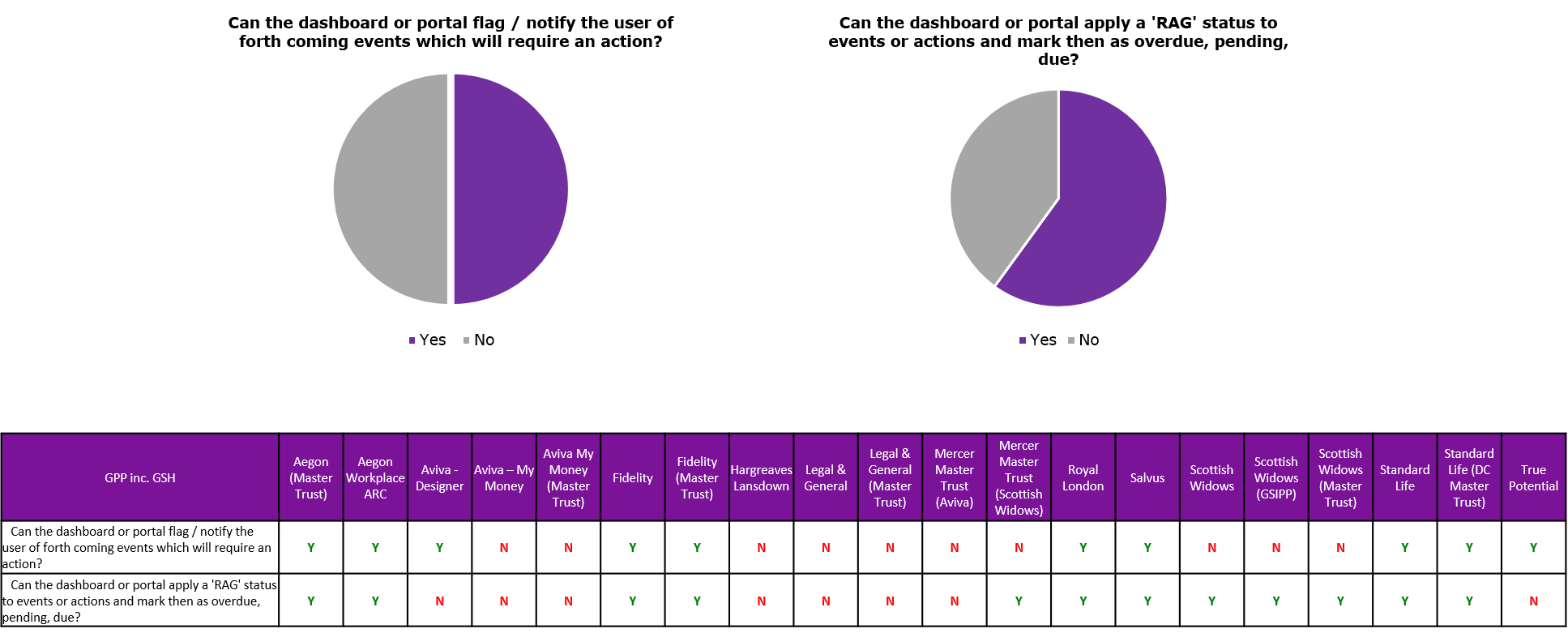

The picture is a little different when it comes to providing flags or notifications to the user of forth coming events or activities which will require an action. Rather disappointingly, fewer providers go to the extent of helping the employer (or other users) with these. Having such functionality available within the primary system used to manage the monthly ongoing requirements would surely be welcomed by all. However currently only 50% of workplace pension providers offer a dashboard or portal that will flag or otherwise notify the user of forthcoming events that will require an action.

In comparison, it is more encouraging to see that over half (60%) of provider dashboards or portals apply a ‘RAG’ status to events or actions and mark them as overdue, pending or due. This simple technique will make managing ongoing duties far easier to manage.

Overall, Legal & General performed the worst in this category due to the fact that they are the only provider to restrict access to the employer alone and do not provide and form of notifications generated by their system.

Royal London, Salvus, Standard Life and Aegon Master Trust shine in this category. Our data shows that their auto-enrolment system capabilities are able to offer all the information necessary for the easiest management of ongoing pension duties.