According to Scottish Widows, one in five (19%) of women under the age of 30 are failing to save anything for retirement.

Our latest insight article looks at the pension gender pay gap, and what the workplace pensions industry can do to address the problem.

A report published by Scottish Widows in November found that women of all ages are less likely than men to be saving for retirement.

Single mothers were the least likely to be saving with four in ten having no form of pension, in comparison to 29% of women overall.

Less than a third of women (30%) planned to rely on a workplace pension to fund their retirement.

The average man between the age of 65 and 74 had over £250,000 of pension assets, in comparison to under £150,000 for the average woman in the same age bracket.

According to the Scottish Widows report, the cost-of-living crisis is exacerbating the existing gender pension gap, exacerbating inequalities and negatively impacting the retirement prospects of UK women.

Think tank Phoenix Insights has called on the government to expand employers’ legal requirements around workplace pension communications to help close the gender pension gap.

According to the think tank, workplace pensions were often negatively impacted by changed to working patterns, with a third of women reducing their hours for an extended period of their career impacting on their retirement savings.

The report called for the government to make it a legal requirement for employers to inform staff of the impact that changes in their working hours may have on their workplace pension contributions.

Phoenix Insights said efforts should be focused on improving pension policy, providing better support for employers and introducing legislative protections for women at life events.

MPs on the influential Work and Pensions Select Committee have previously expressed concerns around the gender pensions gap in their ‘Protecting Pension Savers’ report published last summer.

The report from the group of MPs recommended that the Department for Work and Pensions work with the government to agree a definition of the gender pension gap, and fix a target to reduce it.

It also recommended on the government look at ways to make existing policies work better for lower-paid and part-time workers, including a review of the £10,000 earnings trigger to enter auto-enrolment, which it said would help address the gap.

Although it is well evidenced that women are saving less in pensions, it is unclear if they are using other saving vehicles to help support the shortfall.

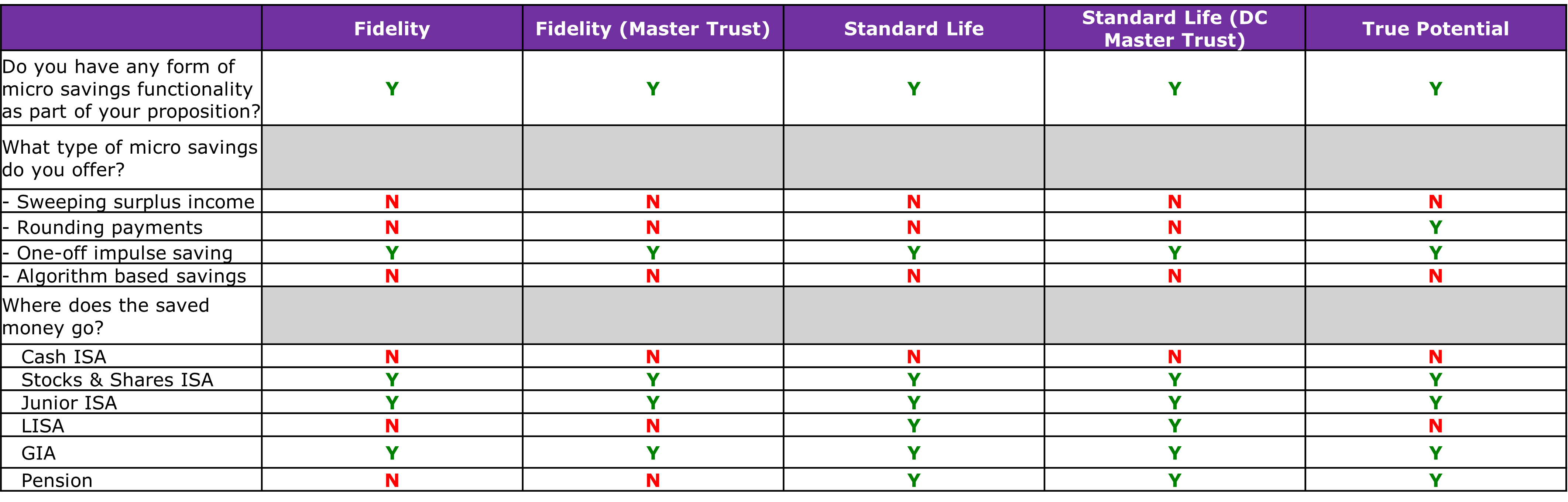

We have been banging the drum for a long time as to the importance of other savings vehicles, particularly micro savings; but these are still only being offered by three providers alongside their pension product.

As seen below, Fidelity, Standard Life and True Potential all support one off micro savings (with True Potential also supporting rounding of payments) – these can be invested in a mixture of ISA, GIA and Pension products. If more providers were offering such products, could this help both men and women accumulate additional savings to assist with retirement?