During their time with an employer, circumstances will no doubt change meaning that a workplace pension member could look to increase their contribution levels several times throughout the lifetime of a policy. This insight investigates how providers support contribution increases and looks at how they can be carried out and by who.

Saving towards a workplace pension is a long-term commitment and throughout the duration of a policy, a member may look to make to make changes to their regular contribution levels or make incremental top ups to their policy. This was the position I found myself in at the later end of last year as a reached a milestone birthday and decided to increase my own pension contributions. However, it was not quite as simple as I thought.

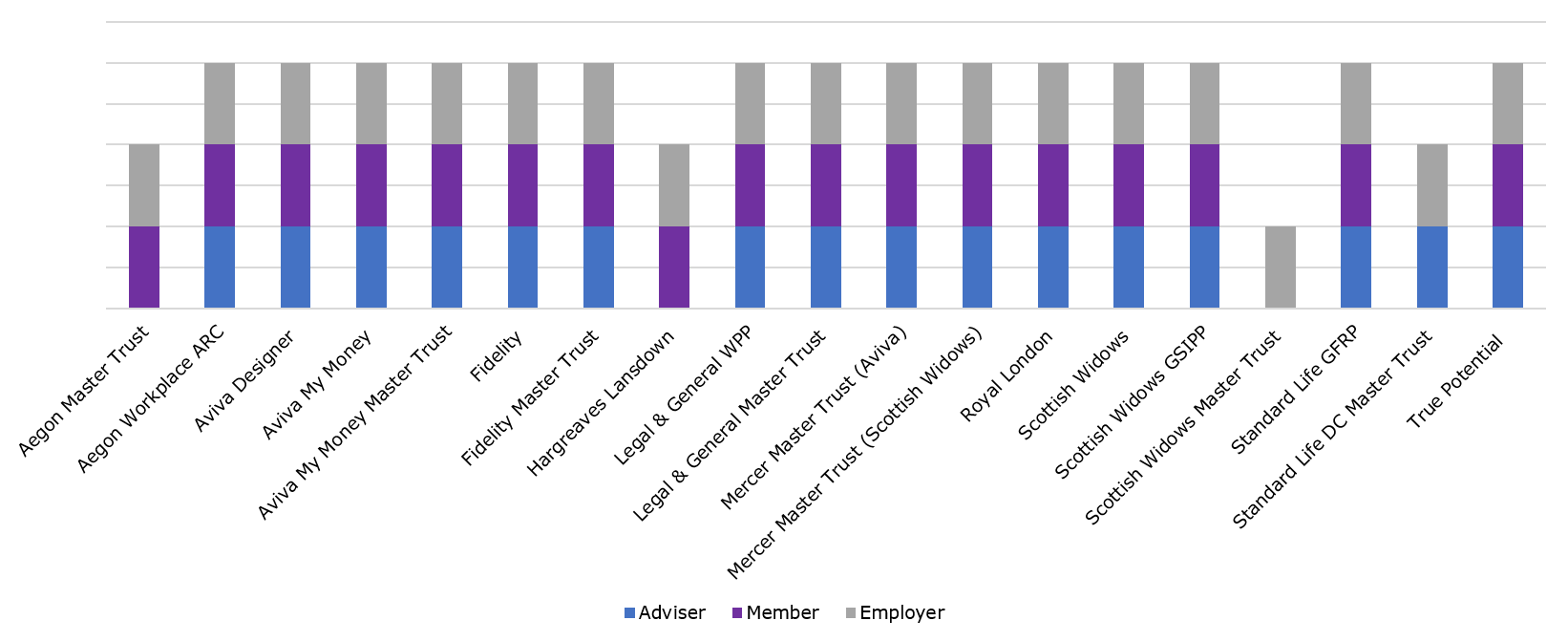

It comes as no surprise that our data shows that all workplace pension providers support incremental top up contributions, and we are pleased to see that all providers can carry these out online. All providers allow this change to be made by the employer.

Most (89%) also allow the member to make the change (Scottish Widows Master Trust and Standard Life DC Master Trust are the only providers not to allow this).

84% of providers also allow advisers to submit incremental contribution increases on behalf of their clients. Only Aegon Master Trust, Hargraves Lansdown and Scottish Widows Master Trust do not allow this.

Increases to all regular premium increments are processed by all providers through the payroll via the employer/administrator or can be processed via an adviser.

Increasing a regular premium is however a slightly different picture. All providers, other than Aviva Designer and Scottish Widows Master Trust, will allow the member to instruct an increase themselves (as well as via the payroll via the employer/administrator or adviser). Most providers do this via an extranet and automatic feed to the employer site to increase an employer submission.

Aviva My Money and Aviva My Money Master Trust create a separate individual contract only with separate direct debit.

Our data shows that when it comes to any additional single contributions, most workplace pension providers support the process with a high level of automation. Only Standard Life and Standard Life DC Master Trust require an application form for single premium increments.

Other than with Hargreaves Lansdown, additional contributions can be automatically identified from payroll. All providers allow additional contributions to be invested automatically, i.e., there is a standard investment instruction.

Other than Mercer Master Trust Scottish Widows and Scottish Widows Master Trust, our data shows that the member can increment direct with the provider.

When it comes to investing these additional single contributions into funds, the picture is a little more varied. Three quarters of providers allow funds to be purchased from a fund platform. The majority (70%) will also allow automatic investment of external funds purchased outside the platform without manual intervention. All providers allow increments be aggregated together with the total investment.

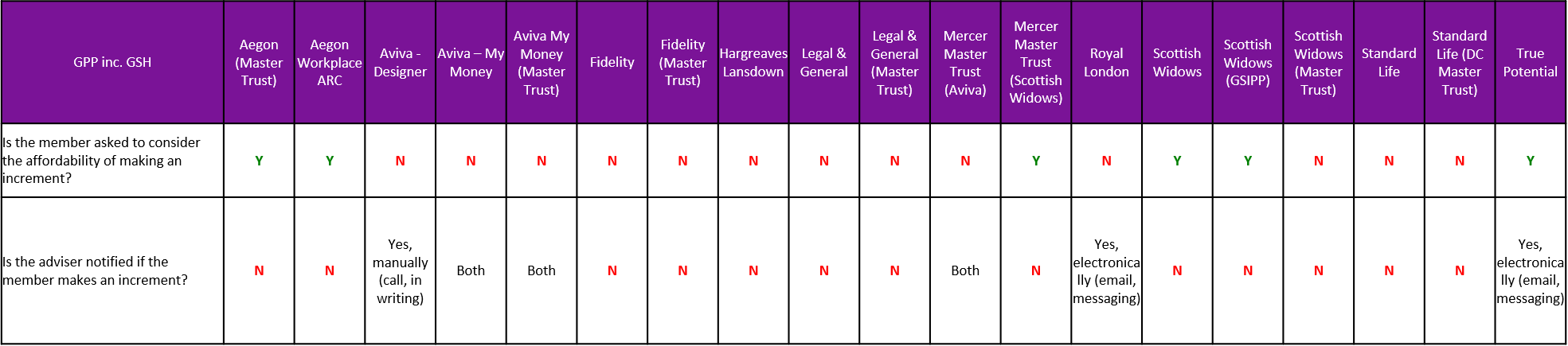

Protecting workplace pension members and making sure they are asked to consider the affordability of making any increment is not something considered by many providers. Only 35% of providers ask the member to consider the affordability of making an increment.

Even less (30%) providers will notify the adviser if the member makes an increase.

During the pandemic more people than ever have been turning to managing their finances online, sometimes at odd hours. Our data shows that the majority of workplace pension providers will allow members to process increments online 24/7 with no downtime. Standard Life and Standard Life DC Master Trust however will only process these during weekday office hours.

Other than True Potential, the process for capturing cases submitted online is signature free. True Potential require a wet signature before the increase can be submitted online as well as requiring an electronic signature during the submission process.

Overall, our data shows that most workplace pension providers have many automated and online systems to make increasing contributions to a scheme as easy as possible. However, Aviva Designer, Scottish Widows Master Trust and Standard Life DC Master Trust have restrictions in place to what members can increase themselves online.