Nowadays, workplace pension members are often looking for more than a pension scheme. They often want easy access to their money and have different savings goals in addition to their retirement saving. In this insight we look at the most common forms of workplace savings schemes and which providers offer what.

According to a recent survey[1], almost three quarters of employees (72%) want their employers to offer a workplace savings scheme in addition to a pension.

The Coronavirus pandemic has also served to help boost workplace savings schemes up the corporate agenda, as employers increasingly look towards assisting their employees’ financial wellbeing. Nine out of ten (92%) of employers would now consider setting up a workplace savings scheme[2] to help employees save to be better prepared for unforeseen situations.

A decade ago, workplace savings were primarily restricted to a pension but now many workplace pension and benefit providers are offering other tax efficient options for saving or investing.

There are many forms of workplace savings schemes offered by workplace pension providers but most fall under three categories: ISAs, LISAs and GIAs.

Individual savings accounts (ISAs) are one of the most popular forms of saving in the UK and therefore it is not surprising that one of the most common form of workplace savings products offered by pension providers is the workplace ISA.

ISAs allow UK savers of the age of 16 to save up to £20,000 every year without paying any tax on the interest earned. The allowance is refreshed in April every year. It is possible to have several ISA accounts open at the same time, but the £20,000 limit applies across all forms of ISA accounts.

Cash ISAs allow savers to protect their interest savings in cash without having to take any form of investment risk. They are easy to open and money can be usually be accessed easily when needed, although some penalties may apply.

A stocks and shares ISA gives the consumer tax-free returns on their investment. Investment decisions are made by a fund manager. As they are a form of investment there is a level of investment risk attached.

A fixed-rate ISA offers tax-free savings at a higher interest rate, but only if the consumer does not withdraw any of the funds. The fixed term may be for the tax year or for a longer period.

Our data shows that three quarters of workplace pension providers offer a workplace ISA to their members. The contributions for the majority of these schemes are made from a single payroll deduction.

Another form of ISA is the Lifetime ISA account. Lifetime ISAs were launched by the government in April 2017. Under a Lifetime ISA, consumers can save up to £4,000 a year and the state will add 25% on top before interest or growth. The bonus is paid until the account holder reaches the age of 50 and is paid monthly into the LISA account. For stocks and shares LISAs the bonus is paid on contribution levels. Under the current rules the maximum bonus achievable from the state through a LISA over the allowable lifetime of contributions (age 18 to 50) is £33,000.

Unless the account holder is over 60 years old or buying a first property, previously the state charged 25% of the amount withdrawn. Under the current rules extended under the Coronavirus pandemic, LISA holders who withdraw money will face a reduced 20% penalty for doing so under April 2022.

However, LISAs have received mixed reviews and have not proven immensely popular with all savers. Our data shows that only one workplace pension provider offers a LISA to their members, Hargreaves Lansdown, however contributions cannot be made from a payroll deduction.

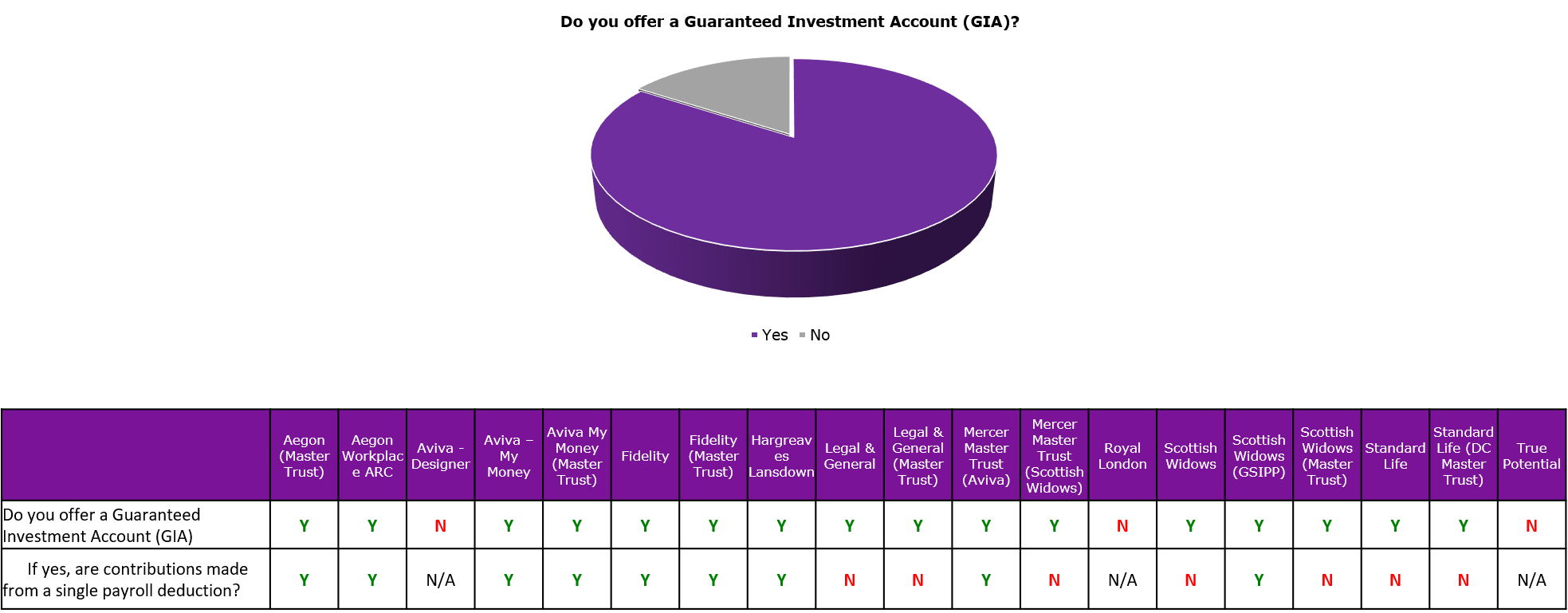

Guaranteed Investment Accounts, otherwise known as GIAs however, are widely offered by workplace pension providers.

Whilst there are no tax benefits for investing in a GIA, they are popular flexible savings option for those who want to invest beyond pension and ISA tax free allowances. As an investment account, savers can choose where they want their funds to be invested and there is no restriction on the amount that can be invested or withdrawn. They are often used to “feed” ISAs and pensions each tax year, moving money into more tax efficient wrappers.

Money saved within a GIA can also utilise the capital gains tax allowance. The capital gains tax threshold is currently £12,300 for the 2020/21 tax year, meaning this amount of gains (investment gains or interest) can be made each year without paying tax.

Our data shows that 80% of workplace pension providers offer a GIA to their members. Just over half of these have contributions made from a single payroll deduction.

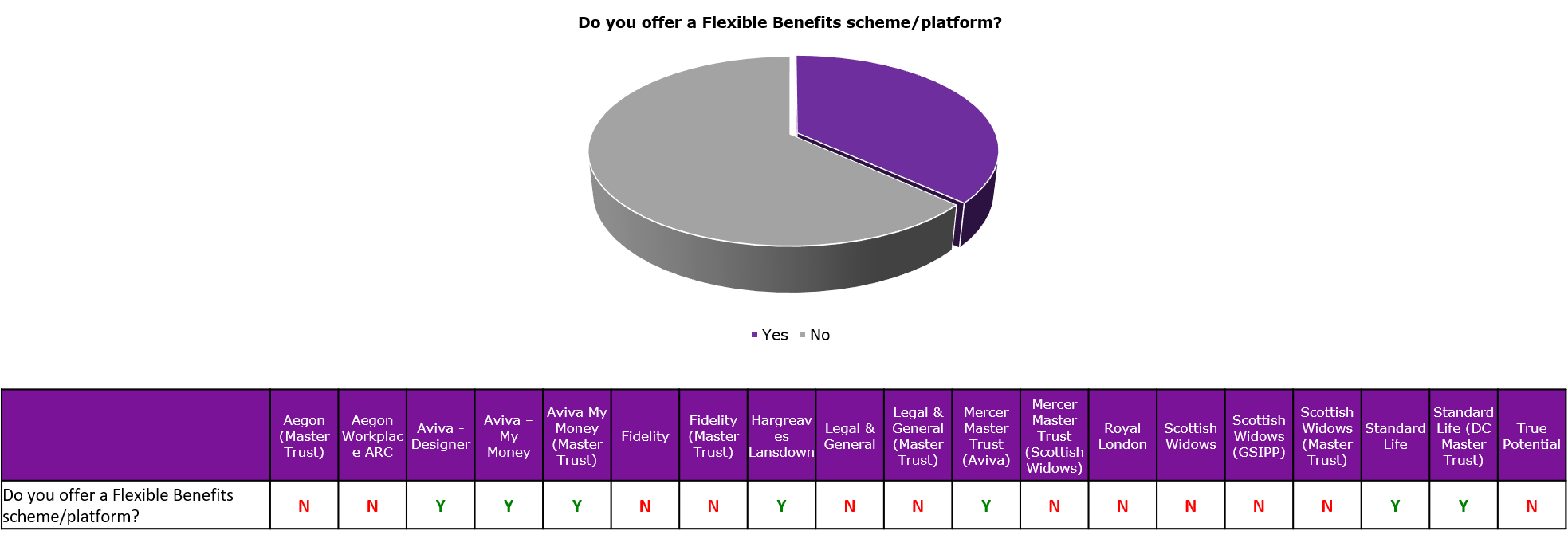

In terms of how these workplace savings schemes are offered, some providers offer these within their workplace pension platform whereas others also, or instead, offer a flexible benefits scheme/platform.

Our data shows that 35% of workplace pension providers also offer a flexible benefits scheme/platform, alongside their pension offering. All these providers offer this as a separate commercial arrangement to their workplace pension platform.

Workplace savings schemes beyond traditional retirement savings are undoubtedly growing in popularity and as we have seen in this insight article, most workplace pension providers can provide such products to their members.

However, some employers may find these kinds of savings products more popular with their employees than others. Some may also make the choice to offer workplace savings products from other workplace benefits providers, separate to their pension provision. Regardless of who is providing the savings vehicles, I think it is clear that people want more options and choice, and we are glad to see that pension providers are expanding their offerings to reflect this.

[1 & 2] Cushon‘s Financial Resilience research conducted amongst 2,000 individuals and 1,000 HR Managers – May 2020