The average Briton changes employer every five years, according to life insurer LV=, which therefore begs the question – what do you do with your workplace pension?

Members will often choose to leave their old employer’s workplace pension scheme when they leave in favour of that of their new employer of a private scheme. Pension consolidation exercises are very popular, as not only can it sometimes mean lower costs, but it is also easier to manage your assets.

This insight explores how pension providers manage the process of members leaving a group scheme and what happens to their accumulated funds.

Upon choosing to leave a workplace pension scheme, our data shows that all members will receive a leavers pack when leaving the scheme from their provider. This paperwork, which will be required when transferring or setting up any new scheme, will be normally processed and dispatched by each provider between 24 hours and a week after leaving the scheme. However, perhaps more importantly, we are pleased to see that all providers in our analysis have confirmed that members will keep their online access to the portal or app so that they can still view their pension details and holdings.

When it comes to how they receive this leavers pack and any other documentation, there is more of a difference between providers. An old-fashioned hard copy of documents sent through the post is the only option for 30% of providers (which as we know can sometimes be a little unreliable as when we move to a new house, telling our pension provider is not high on the list), 5% will send it electronically, and the remaining 65% of providers will send both a hard copy and a digital one.

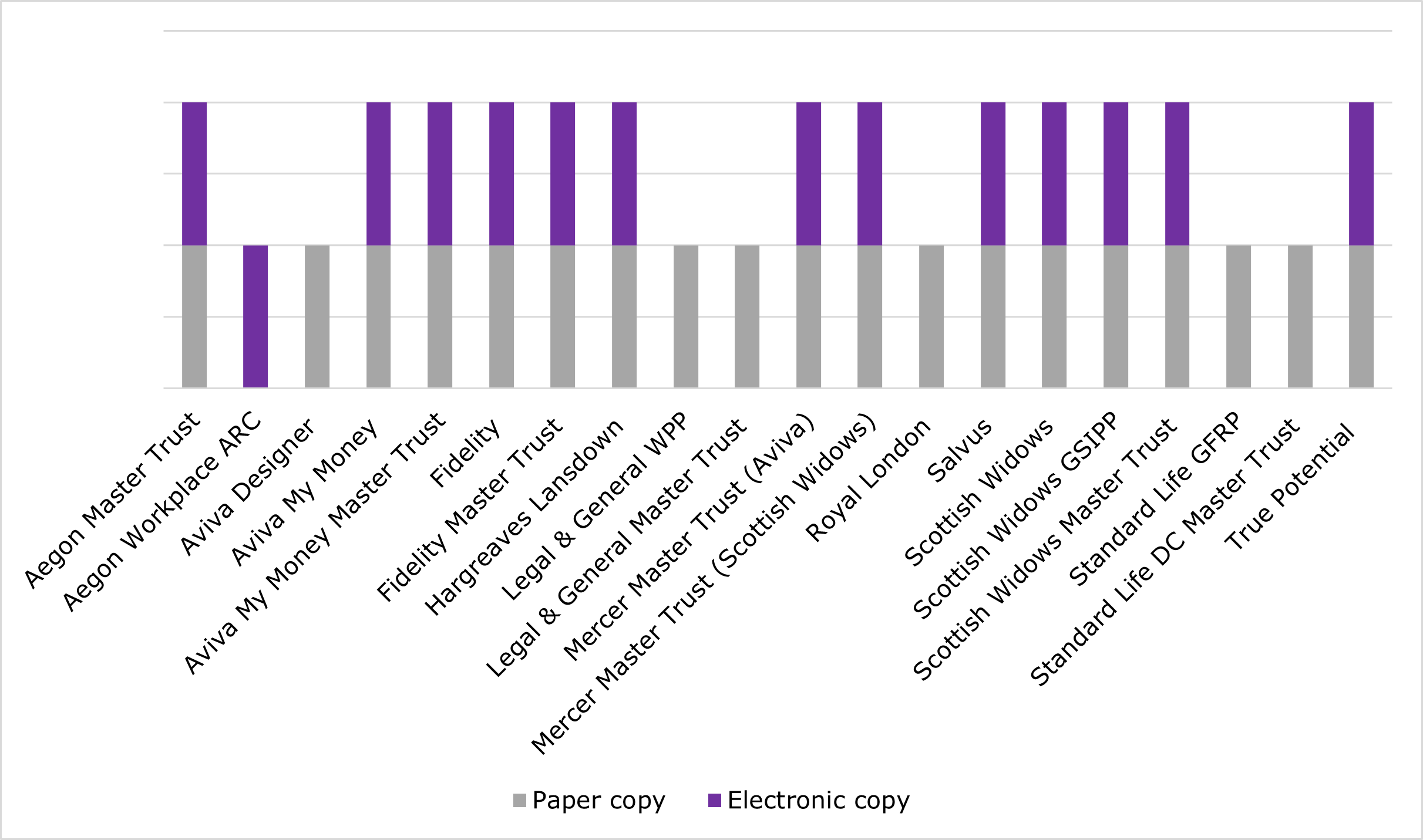

Most providers will also send a copy of the leaver documents to the member’s adviser, should they have one in place. Over half of providers (65%) send the documents to the adviser via a hard copy. Fidelity, Fidelity Master Trust, Hargreaves Lansdown and True Potential will send a paper copy and an electronic one. Aegon Master Trust, Aegon Workplace ARC and Salvus do not send any of these documents to the adviser.

When it comes to keeping the adviser notified as to the member’s actions, our data shows that only 40% of workplace pension members will generate a notification. All of this 40% will do this electronically, ie email or messaging, while 30% will also generate a notification manually, ie a phone call or in writing. The providers who generate notifications for the adviser will also send a ceasing of regular payment notification which will be generated automatically via the payroll.

All workplace pension provider systems automatically identify members near retirement choosing to leave the scheme and flag this. Dependent on the provider, these notifications are sent out when the member leaving the scheme is doing so between 6 months and two years before their nominated retirement date.

Half of providers will also notify the adviser. Aviva Designer, Aviva My Money, Aviva My Money Master Trust and Mercer Master Trust (Aviva) will do this manually, whereas Aegon Workplace ARC and Royal London notify the adviser electronically. Aegon Master Trust, Scottish Widows, Standard Life, and Standard Life DC Master Trust will notify the adviser both manually and electronically.

Other than Salvus, Hargreaves Lansdown, and Scottish Widows GSIPP, should a member leave the employer the adviser who set up the scheme can continue to access information.

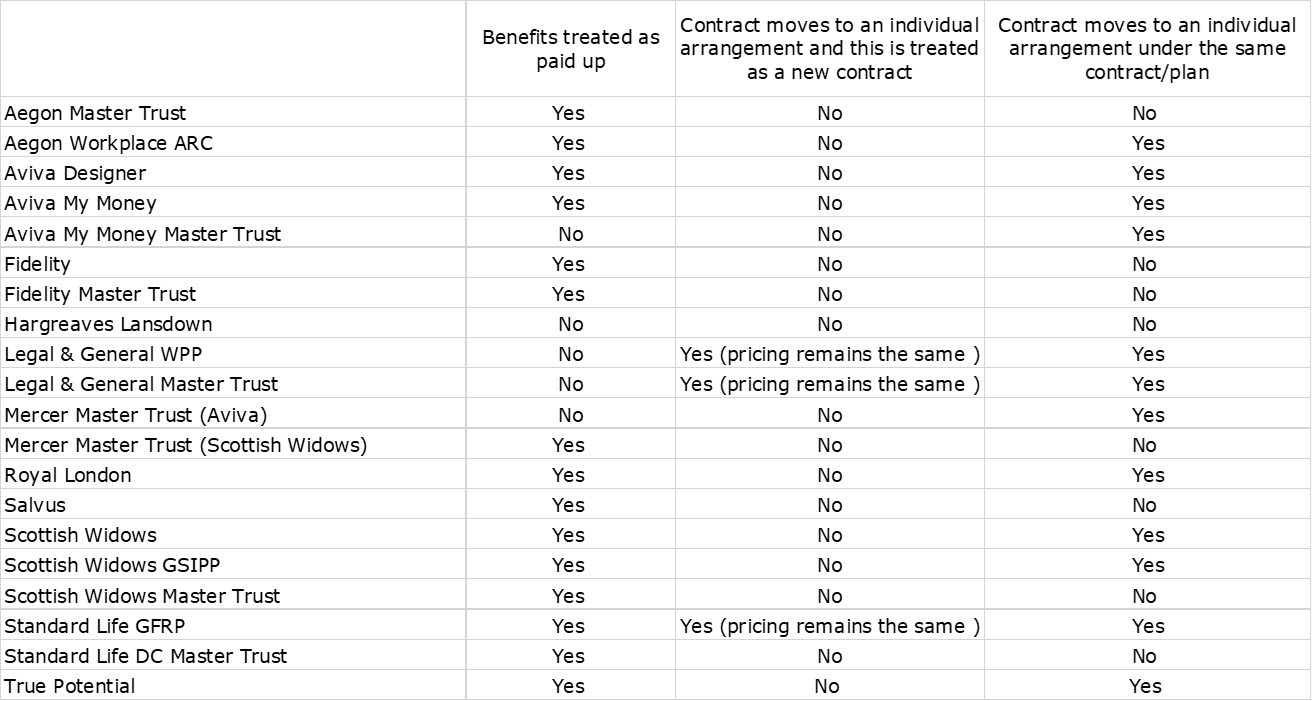

If a member leaves the employer, for the majority (75%), benefits are treated as paid up. Only Aviva My Money Master Trust, Hargreaves Lansdown, Legal & General, Legal & General Master Trust and Mercer Master Trust (Aviva) take a different approach.

With over half (60%) of workplace pension providers, when a member leaves the employer the contract moves to an individual arrangement under the same contract/plan.

For three providers (Legal & General, Legal & General Master Trust and Standard Life), the contract moves to an individual arrangement and is treated as a new contract. Pricing remains the same.

The remainder of providers have members stay as deferred under the scheme, move to an “orphans” plan or can retain the existing plan as it stands.

Our data shows that if a member is leaving the employer within two years, no workplace pension providers offer the member a refund of their contributions.

Should a member change employer, with all workplace pension providers there is a provision of a drawdown facility for post-retirement benefits.

Should a large number of individuals choose to leave the scheme for reasons such a redundancy, whole team moves or the employer wishes to offer an alternative scheme, our data shows that all providers have an automated bulk member leaver process to assist with the process and make life easier.

Overall, our data shows that workplace pension providers make it fairly seamless for a member to leave the scheme and provide the literature they need on a variety of mediums. However, it is worth noting that when it comes to keeping the adviser informed there is a lot more difference between the treatment between providers and how in the loop they are kept.