Financial wellness is now seen and recognised as a key component of any workplace pension proposition. However, the support and services being offered differs dramatically between providers. As part of Talk Money Week this is the first of a two-part insight exploring what services and tools providers are offering as part of their financial wellness solutions.

The Coronavirus pandemic has exacerbated the financial problems of many people in the UK making financial wellness propositions an increasing priority for many employers who are reviewing and/or selecting a workplace pension provider.

According to the Nudge UK HR professionals report in August 2020, more than half of UK workers worry about money issues at least once a week. It stated that the majority of employers surveyed (88%) said that upper management could do more to promote the financial wellbeing of their employees. Those employers who did have a financial wellbeing solution in place said it had had a tangible impact on their business, with 43% stating it helped employee retention and made employees happier.

Workplace pension providers are perfectly placed to help address the growing importance of financial wellness and we are pleased that our data shows that all workplace pension providers in our analysis are offering some form of financial wellness as part of their offering.

At the heart of these propositions is financial education. All providers support members in understanding how good their level of financial knowledge, products and education is. Our data shows all providers are offering this support online and via app or mobile device. Additionally, 80% are offering support face to face, 80% via interactive services, and 85% via group sessions.

Most providers have also commissioned their own research to further understand what their members want and how they can help them.

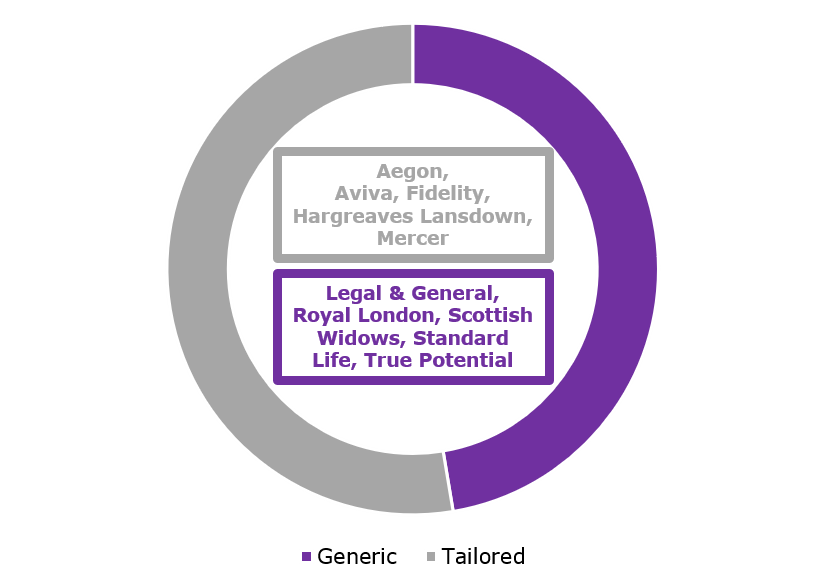

Different workplace pension members at different stages of life and different levels of education/experience have different needs when it comes to financial education. However, just over half (55%) of workplace pension providers only offer generic educational information, whereas nine providers tailor the information to the user.

Ask a financial adviser what the most important things are to consider when getting your finances in order, they will likely include budgeting and goal setting in the list.

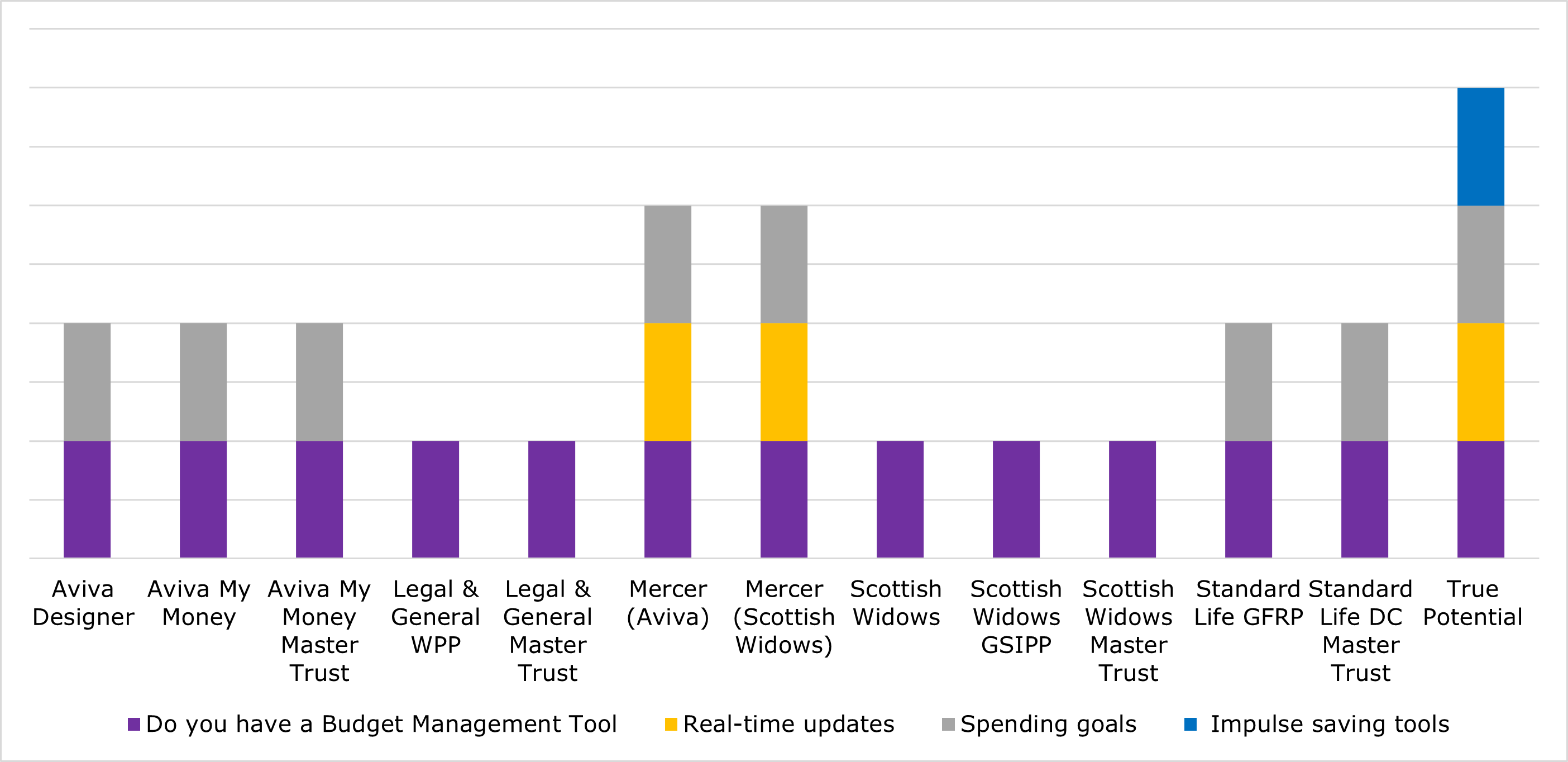

Our data shows that 60% of workplace pension providers provide an automated budget management tool. Some providers offer a very basic budget management tool with very few add-ons. However, some other providers enable their members to personalise the tool.

Mercer Master Trust and True Potential offer the most options when it comes to their budget management tools. Their budgeting tools are able to support real-time updates, automatic categorisation of personal spending, the ability for the user to edit add and remove categories to make it personal to them and allow the user to set up spending goals.

Our data shows that fewer providers offer savings goals tools. Only Fidelity, Legal & General, Standard Life and True Potential offer one. Unlike any other provider, True Potential has a savings goal manager that receives real-time updates from the client’s budget management tool and includes their ‘Impulse Save’ instant savings tool.

Another area where you may be able to improve your finances is to make sure that you regularly check you are receiving the best deal for your credit cards, mortgage, loan agreements and utilities. Our data shows that currently no workplace pension provider offers any kind of comparison service or links to any third-party comparison sites.

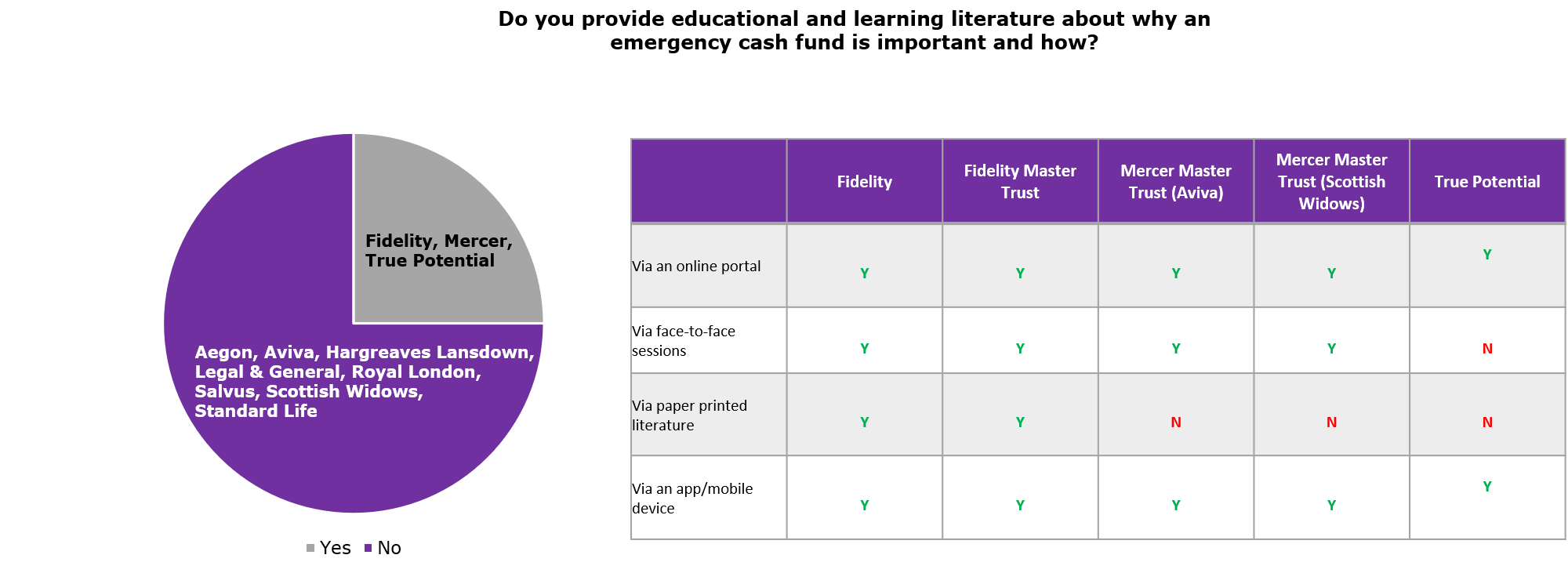

Building an emergency cash fund so that you have access to savings in the case of unexpected events should form part of anyone’s financial plan. Currently this is an area which is underserved in the financial wellness propositions of workplace pension providers. Our data shows that not a single workplace pension provider currently has the facility to help members create an emergency cash fund; however, a quarter of providers do provide educational literature about why an emergency cash fund is important.

Smart savings is also not well represented. Only True Potential can facilitate smart saving as their proposition includes personal budgets and via open banking the ability to read and understanding the users current spending habits. They are also the only provider whose proposition facilitates smart spending. This includes personal budgets, reading/understanding current spending habits, and identifies each month how much money the user has left of their budget to spend or save. It does not however currently include safe to spend limits, location services, or personal notifications to alert the user when they are close to reaching their spending capacity.

Regularly reviewing any debt you hold is another area that is key for financial wellbeing. In the last twelve months, 44% of UK adults have run out of money before their next pay day at least once and 60% of households are holding some form of debt.

Despite increasing financial stress placed on many workers due to the Coronavirus pandemic, only 30% of workplace pension providers include a debt management tool in their financial wellness proposition. These providers are Aviva, Mercer Master Trust and True Potential.

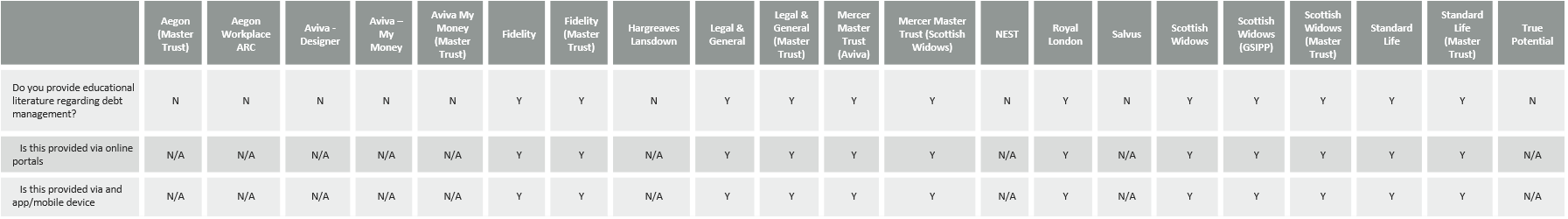

The provision of educational literature regarding debt management is however more prevalent, with 60% of providers offering this via online portals and application/mobile devices.

Just a quarter (25%) of providers work with a third-party debt management company to help support their customers in this area.

Open Banking has meant that the UK’s largest banks can now release their data in a secure, standardised form, so it can be shared more easily between authorised organisations online (once you have approval and all the correct processes in place). As a result, consumers have begun to become used to seeing multiple products, often from multiple providers, through one mobile application which can make managing your finances easier.

Our data shows that currently only three workplace pension providers use Open Banking technologies, however an additional 20% expect to start using Open Banking technology in Q4 2021.

Of the three providers who use Open Banking, two are using third party/partner technology whilst the other has developed their own. As Scottish Widows is owned by the Lloyds Banking Group, it is perhaps unsurprising that they should be the first provider to develop their own technology.

In terms of third-party Open Banking technology partners, True Potential use Yodlee, whereas Mercer Master Trust have partnered with Moneyhub. Aegon and Fidelity are two of the providers looking to develop Open Banking technology for Q4 2021.

This insight will be continued next week where we explore who has micro savings functionality, who can support vulnerable customers, what communication support is available, and how pension providers are broadening their wellness offerings.